Growing Focus on Quality Assurance

Quality assurance remains a critical focus within the Industrial Computed Tomography Market, as companies strive to meet stringent quality standards. The increasing complexity of products necessitates more sophisticated inspection methods to identify defects and ensure compliance with regulatory requirements. Industries such as oil and gas, where safety is paramount, are particularly reliant on advanced inspection technologies. The market for quality assurance solutions is anticipated to expand, with estimates suggesting a growth rate of around 6% annually. This emphasis on quality assurance is likely to drive the adoption of industrial computed tomography, as it provides a reliable means of ensuring product safety and performance.

Expansion of Manufacturing Capabilities

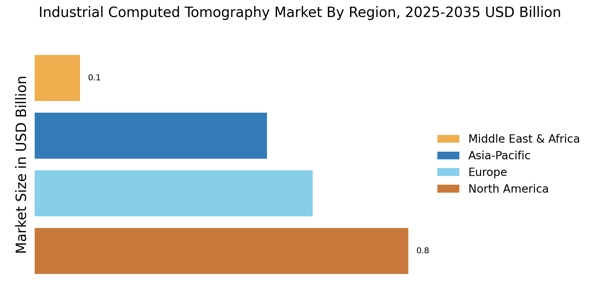

The expansion of manufacturing capabilities across various sectors is significantly influencing the Industrial Computed Tomography Market. As manufacturers seek to optimize production processes and enhance product quality, the demand for advanced inspection technologies is increasing. This trend is particularly evident in emerging markets, where industrial growth is accelerating. The manufacturing sector is projected to grow at a CAGR of approximately 5% in the next few years, leading to a heightened need for effective inspection solutions. Industrial computed tomography offers manufacturers the ability to conduct thorough inspections without compromising production timelines, thereby supporting the overall growth of the market.

Rising Demand for Non-Destructive Testing

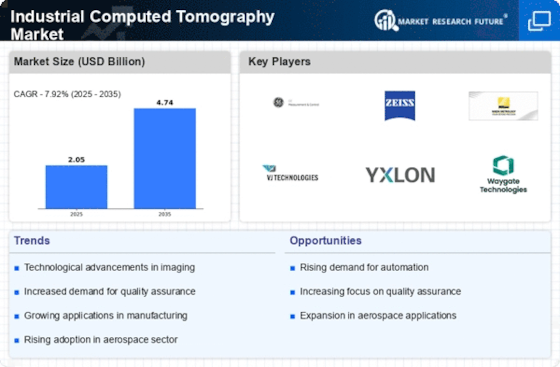

The Industrial Computed Tomography Market is experiencing a notable increase in demand for non-destructive testing (NDT) methods. Industries such as aerospace, automotive, and manufacturing are increasingly adopting NDT techniques to ensure product integrity and safety. This trend is driven by the need for high-quality standards and the reduction of material waste. According to recent data, the NDT market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next few years. As companies seek to enhance their quality control processes, the adoption of industrial computed tomography is likely to rise, further propelling the market forward.

Integration of Advanced Imaging Technologies

The integration of advanced imaging technologies into the Industrial Computed Tomography Market is a significant driver of growth. Innovations such as 3D imaging and high-resolution scanning capabilities are enhancing the accuracy and efficiency of inspections. These advancements allow for more detailed analysis of complex components, which is particularly beneficial in sectors like electronics and medical device manufacturing. The market for imaging technologies is expected to witness substantial growth, with projections indicating a potential increase in market size by over 20% in the coming years. This integration not only improves inspection processes but also reduces operational costs, making it a compelling choice for manufacturers.

Increased Investment in Research and Development

Increased investment in research and development (R&D) is a pivotal driver for the Industrial Computed Tomography Market. Companies are allocating substantial resources to innovate and enhance their inspection technologies, aiming to stay competitive in a rapidly evolving market. This focus on R&D is expected to yield advancements in imaging techniques and software solutions, which could lead to more efficient and accurate inspection processes. The R&D expenditure in the industrial sector is projected to rise by approximately 8% annually, indicating a strong commitment to technological advancement. Such investments are likely to foster the growth of industrial computed tomography, as new developments emerge to meet the evolving needs of various industries.