Growth in Chemical Manufacturing

The Industrial Carbon Dioxide Market is significantly influenced by the growth in chemical manufacturing. Carbon dioxide serves as a vital raw material in the production of various chemicals, including urea, methanol, and ammonium carbonate. The chemical sector is expected to witness a compound annual growth rate of around 4% through 2025, which will likely drive the demand for industrial carbon dioxide. Furthermore, the increasing focus on sustainable chemical processes may lead to a higher adoption of carbon dioxide as a feedstock, as it can be utilized in carbon capture and utilization technologies. This shift towards greener practices in chemical manufacturing could potentially enhance the market dynamics for industrial carbon dioxide, as companies seek to reduce their carbon footprint while maintaining production efficiency.

Expanding Applications in Healthcare

The Industrial Carbon Dioxide Market is witnessing expanding applications in the healthcare sector, which is contributing to its growth. Carbon dioxide is utilized in various medical applications, including insufflation during minimally invasive surgeries and as a refrigerant in cryotherapy. The increasing prevalence of chronic diseases and the rising demand for advanced medical procedures are likely to drive the need for carbon dioxide in healthcare settings. In 2025, the healthcare sector is projected to account for a notable share of the industrial carbon dioxide market, with an expected growth rate of around 5%. This trend underscores the versatility of carbon dioxide and its critical role in enhancing medical technologies, thereby further solidifying its position in the industrial carbon dioxide market.

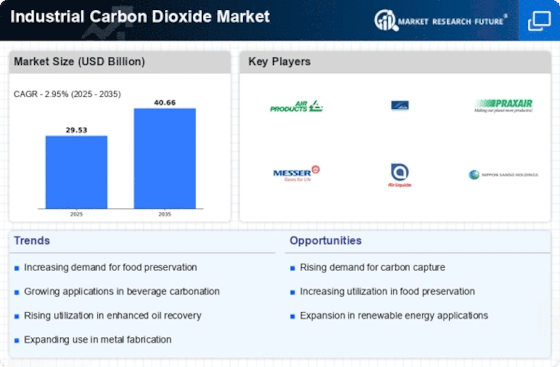

Rising Demand in Food and Beverage Sector

The Industrial Carbon Dioxide Market experiences a notable surge in demand from the food and beverage sector. Carbon dioxide is extensively utilized in carbonation processes, enhancing the taste and shelf life of beverages. In 2025, the beverage industry is projected to account for approximately 30% of the total carbon dioxide consumption. This trend is driven by the increasing consumer preference for carbonated drinks and the expansion of the food processing industry. Additionally, the growing trend of convenience foods necessitates the use of carbon dioxide for packaging and preservation, further propelling the market. As consumers become more health-conscious, the demand for natural and organic beverages is also rising, which may lead to an increased reliance on carbon dioxide for maintaining product quality and freshness.

Enhanced Focus on Environmental Regulations

The Industrial Carbon Dioxide Market is also shaped by the enhanced focus on environmental regulations. Governments worldwide are implementing stricter regulations aimed at reducing greenhouse gas emissions, which may lead to increased investments in carbon capture and storage technologies. As industries strive to comply with these regulations, the demand for industrial carbon dioxide is expected to rise, particularly in sectors such as energy and manufacturing. In 2025, it is anticipated that compliance costs associated with emissions regulations could drive a 10% increase in carbon dioxide utilization across various industries. This regulatory landscape not only encourages the adoption of cleaner technologies but also positions carbon dioxide as a critical component in achieving sustainability goals, thereby influencing market growth.

Technological Innovations in Carbon Capture

Technological innovations in carbon capture and utilization are emerging as a pivotal driver for the Industrial Carbon Dioxide Market. Advances in carbon capture technologies are enabling industries to capture carbon dioxide emissions more efficiently, which can then be repurposed for various applications. For instance, the development of direct air capture technologies is gaining traction, allowing for the extraction of carbon dioxide from the atmosphere. This captured carbon dioxide can be utilized in the production of fuels, chemicals, and even in enhanced oil recovery processes. As these technologies continue to evolve, they may significantly alter the landscape of the industrial carbon dioxide market, potentially leading to a more circular economy where carbon dioxide is viewed as a valuable resource rather than a waste product.