North America : Market Leader in Automation

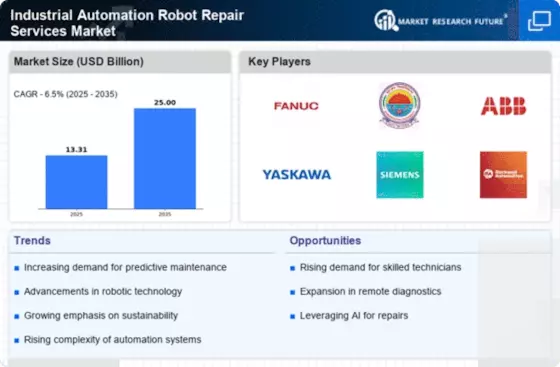

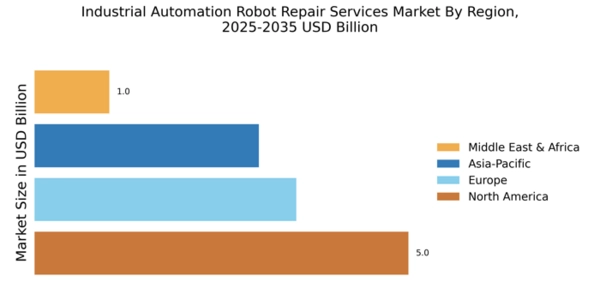

North America is poised to maintain its leadership in the Industrial Automation Robot Repair Services market, holding a significant market share of 5.0 in 2025. The region's growth is driven by rapid technological advancements, increased automation across industries, and a strong focus on operational efficiency. Regulatory support for automation technologies further fuels demand, as companies seek to enhance productivity and reduce downtime. The competitive landscape in North America is robust, featuring key players such as Rockwell Automation, Siemens, and ABB. The U.S. stands out as a leader in adopting advanced robotics, with substantial investments in manufacturing and service sectors. This environment fosters innovation and collaboration among industry leaders, ensuring that North America remains at the forefront of the robot repair services market.

Europe : Innovation and Sustainability Focus

Europe's Industrial Automation Robot Repair Services market is projected to reach a size of 3.5 by 2025, driven by a strong emphasis on sustainability and innovation. The region's regulatory frameworks encourage the adoption of advanced robotics, enhancing operational efficiency and reducing environmental impact. As industries increasingly rely on automation, the demand for repair services is expected to rise, supported by government initiatives promoting technological advancements. Leading countries in Europe, such as Germany and France, are home to major players like KUKA and Schneider Electric. The competitive landscape is characterized by a mix of established firms and emerging startups, all striving to innovate and meet the growing demand for efficient repair services. This dynamic environment positions Europe as a key player in the global market for robot repair services.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the Industrial Automation Robot Repair Services market, projected to reach 3.0 by 2025. This growth is fueled by increasing industrial automation, particularly in manufacturing and logistics sectors. Countries like Japan and China are leading the charge, with substantial investments in robotics technology and a growing demand for maintenance and repair services to ensure operational efficiency. The competitive landscape in Asia-Pacific is vibrant, featuring key players such as Fanuc and Yaskawa. These companies are at the forefront of innovation, providing advanced solutions to meet the rising demand for robot repair services. As the region continues to embrace automation, the market is expected to expand rapidly, driven by both domestic and international players seeking to capitalize on emerging opportunities.

Middle East and Africa : Developing Market Landscape

The Middle East and Africa region is gradually emerging in the Industrial Automation Robot Repair Services market, with a projected size of 1.0 by 2025. The growth is primarily driven by increasing investments in automation technologies across various sectors, including manufacturing and oil & gas. Governments are recognizing the importance of automation in enhancing productivity, leading to supportive policies and initiatives that encourage technological adoption. Countries like South Africa and the UAE are taking the lead in this transformation, with a growing presence of key players in the automation sector. The competitive landscape is evolving, with both local and international firms vying for market share. As the region continues to develop its industrial capabilities, the demand for robot repair services is expected to rise, presenting significant growth opportunities for service providers.