Market Trends

Key Emerging Trends in the Industrial Agitator Market

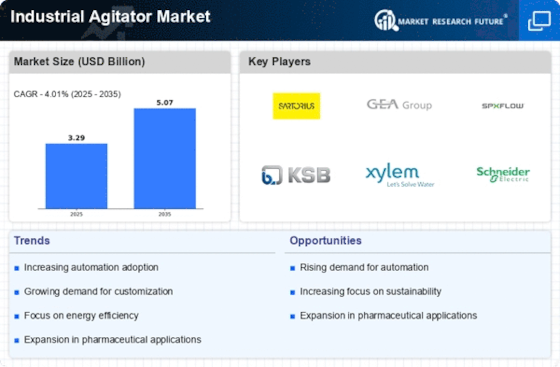

The Industrial Agitator market is witnessing several noteworthy trends that are shaping its trajectory and influencing the preferences of both manufacturers and end-users. One prominent trend is the integration of smart technologies and automation in agitator systems. As industries embrace the era of Industry 4.0, agitators are increasingly equipped with sensors, advanced control systems, and connectivity features. This not only enhances the efficiency of mixing processes but also allows for real-time monitoring and control, contributing to improved productivity and reduced operational costs.

Energy efficiency is another significant trend in the Industrial Agitator market. With a growing emphasis on sustainability and environmental responsibility, manufacturers are developing agitators that consume less energy while maintaining optimal performance. Energy-efficient agitators not only align with the global push for greener practices but also help industries reduce their overall energy consumption and operational expenses.

Customization to meet industry-specific requirements is a prevailing trend in the Industrial Agitator market. Different sectors, such as chemicals, pharmaceuticals, and food and beverages, have unique mixing challenges and specifications. Manufacturers are responding by offering tailored agitator solutions that address the specific needs of each industry. This trend allows end-users to benefit from agitators that are optimized for their particular applications, leading to increased efficiency and better overall outcomes.

The adoption of modular designs is gaining traction in the Industrial Agitator market. Modular agitators consist of interchangeable components, allowing for easy customization, maintenance, and upgrades. This trend provides flexibility to end-users, enabling them to adapt their agitator systems to changing production requirements without significant downtime or the need for a complete system overhaul.

Collaborations and partnerships between agitator manufacturers and end-users are becoming more prevalent. By working closely with industries such as chemicals, pharmaceuticals, and biotechnology, agitator manufacturers can gain insights into specific challenges and requirements. These collaborations foster the development of agitators that are precisely tailored to meet the evolving needs of various sectors, driving innovation and enhancing the overall efficiency of mixing processes.

Hygienic design and compliance with stringent regulatory standards are emerging as critical trends in the Industrial Agitator market, particularly in industries such as pharmaceuticals and food and beverages. Agitators must adhere to strict cleanliness and safety standards to meet the regulatory requirements of these sectors. Manufacturers are investing in the development of agitators with hygienic designs, easy cleanability, and materials that comply with industry-specific regulations, ensuring the integrity of the end product and the safety of consumers.

Remote monitoring and predictive maintenance are gaining prominence as part of the Industrial Agitator market trends. Manufacturers are incorporating connectivity features that enable remote monitoring of agitator performance. This facilitates real-time diagnostics, preventive maintenance, and the early detection of potential issues. Predictive maintenance not only reduces downtime but also extends the lifespan of agitator systems, offering cost savings for end-users.

Globalization is impacting the Industrial Agitator market trends, with manufacturers expanding their presence in emerging markets. As industrial activities grow in regions such as Asia-Pacific and Latin America, agitator manufacturers are establishing a stronger foothold in these markets. This trend allows companies to tap into new opportunities, cater to the needs of diverse industries, and strengthen their position as global players.

Leave a Comment