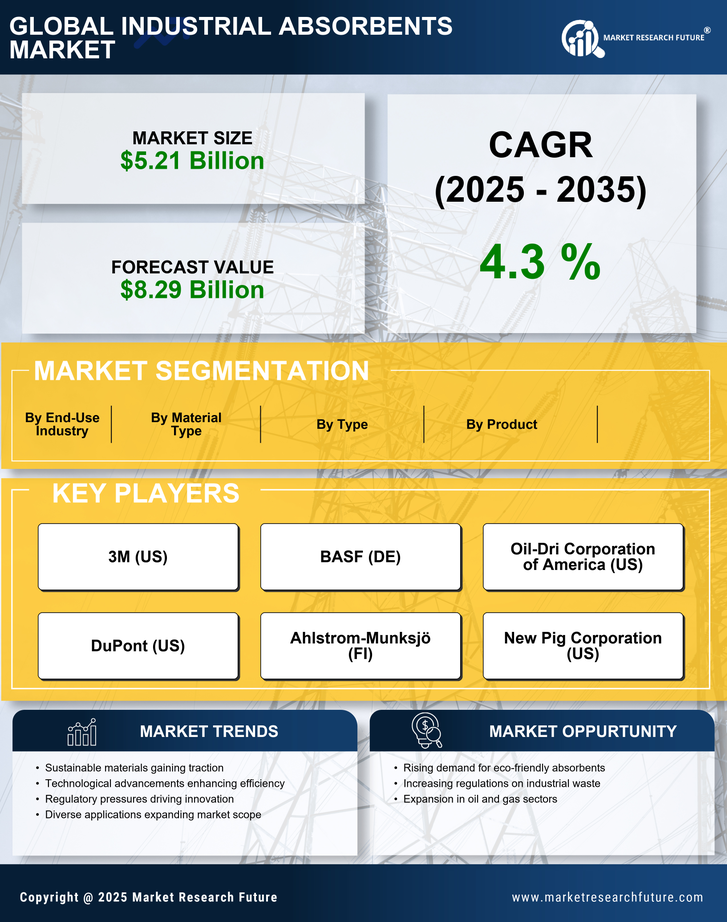

Rising Environmental Concerns

The increasing awareness regarding environmental issues appears to be a primary driver for the Industrial Absorbents Market. Companies are under pressure to adopt sustainable practices, leading to a heightened demand for absorbents that can effectively manage spills and leaks. This shift is reflected in the market, where the demand for eco-friendly absorbents is projected to grow significantly. The Industrial Absorbents Market is likely to benefit from this trend, as organizations seek products that not only comply with environmental regulations but also enhance their corporate social responsibility profiles. As a result, manufacturers are innovating to create absorbents made from renewable resources, which could potentially capture a larger market share.

Stringent Regulatory Frameworks

The implementation of stringent regulatory frameworks concerning environmental protection and workplace safety is a critical driver for the Industrial Absorbents Market. Governments are increasingly mandating compliance with regulations that require industries to have effective spill management systems in place. This regulatory pressure is compelling companies to invest in high-quality absorbents to avoid penalties and ensure operational continuity. The Industrial Absorbents Market is likely to see a surge in demand as organizations prioritize compliance with these regulations. Furthermore, the evolving nature of these regulations suggests that manufacturers must remain agile and responsive to maintain their market positions.

Increased Focus on Workplace Safety

The heightened emphasis on workplace safety is emerging as a significant driver for the Industrial Absorbents Market. Organizations are recognizing the importance of maintaining safe working environments, particularly in sectors prone to spills and leaks. This focus is leading to increased investments in safety equipment, including absorbents. Market trends indicate that companies are allocating more resources towards training and implementing spill response protocols, which in turn drives the demand for effective absorbent solutions. The Industrial Absorbents Market is likely to benefit from this trend, as businesses seek to enhance their safety measures and reduce the risk of accidents.

Technological Innovations in Absorbent Materials

Technological advancements in the development of absorbent materials are significantly influencing the Industrial Absorbents Market. Innovations such as superabsorbent polymers and advanced composites are enhancing the efficiency and effectiveness of absorbents. These materials are designed to absorb larger volumes of liquids while minimizing waste. Market analysis suggests that the introduction of these innovative products could lead to a substantial increase in market penetration. As industries seek to optimize their spill response strategies, the demand for high-performance absorbents is likely to rise. This trend indicates a shift towards more sophisticated solutions within the Industrial Absorbents Market, potentially reshaping competitive dynamics.

Growth in Manufacturing and Industrial Activities

The expansion of manufacturing and industrial activities is a notable driver for the Industrial Absorbents Market. As industries such as automotive, chemicals, and food processing continue to grow, the need for effective spill management solutions becomes increasingly critical. The market data indicates that the manufacturing sector is expected to witness a compound annual growth rate (CAGR) of approximately 4.5% over the next few years. This growth is likely to translate into a higher demand for industrial absorbents, as companies strive to maintain safety and compliance standards. Consequently, the Industrial Absorbents Market is poised to experience robust growth, driven by the rising operational complexities in various sectors.