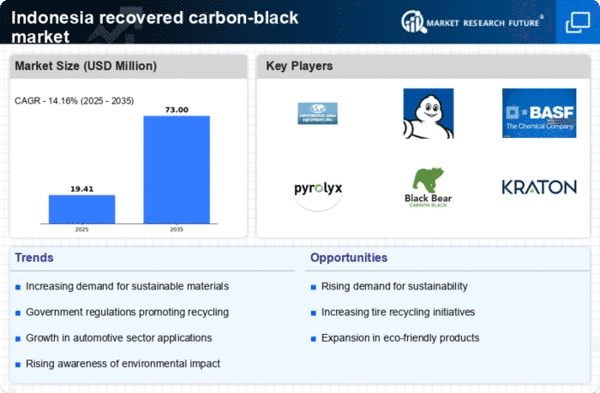

The recovered carbon-black market in Indonesia is characterized by a dynamic competitive landscape, driven by increasing demand for sustainable materials and stringent environmental regulations. Key players such as Continental AG (DE), Michelin (FR), and BASF SE (DE) are actively positioning themselves through innovation and strategic partnerships. For instance, these companies are focusing on enhancing their production processes to improve the quality and sustainability of recovered carbon black, which is crucial for meeting the evolving needs of the tire and rubber industries. Their collective strategies not only foster competition but also contribute to a more sustainable market environment.In terms of business tactics, companies are increasingly localizing manufacturing to reduce logistics costs and enhance supply chain efficiency. The market appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they leverage their resources to optimize operations and expand their market presence. This competitive structure suggests that while there is room for smaller players, the dominance of established firms shapes market dynamics.

In October Pyrolyx AG (DE) announced a strategic partnership with a local Indonesian tire manufacturer to enhance the supply chain for recovered carbon black. This collaboration is expected to streamline production processes and reduce costs, thereby increasing the availability of sustainable materials in the region. Such partnerships are indicative of a broader trend where companies seek to integrate more closely with local markets to enhance operational efficiency and sustainability.

In September Black Bear Carbon (NL) launched a new facility in Indonesia aimed at increasing its production capacity for recovered carbon black. This expansion is significant as it not only boosts local production but also aligns with the growing demand for eco-friendly materials in the automotive sector. The facility is expected to utilize advanced technologies that enhance the recovery process, thereby improving the overall quality of the product.

In August Michelin (FR) unveiled its latest initiative focused on digital transformation within its supply chain operations in Indonesia. By implementing AI-driven analytics, the company aims to optimize its logistics and inventory management, which could lead to reduced operational costs and improved service delivery. This move reflects a broader trend in the industry where digitalization is becoming a key differentiator in competitive strategy.

As of November the competitive trends in the recovered carbon-black market are increasingly defined by digitalization, sustainability, and technological integration. Strategic alliances are playing a crucial role in shaping the landscape, as companies collaborate to enhance their capabilities and market reach. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, underscoring the importance of sustainable practices in the industry.