Growing Automotive Sector

The expansion of the automotive sector in the GCC is a significant driver for the recovered carbon-black market. As the region's automotive industry continues to grow, the demand for high-performance materials, including carbon black, is on the rise. The recovered carbon-black market is well-positioned to capitalize on this trend, as manufacturers seek sustainable alternatives to traditional carbon black. In 2025, the automotive sector is expected to account for approximately 30% of the total demand for recovered carbon black in the region. This growth is driven by the increasing adoption of eco-friendly tires and components, which utilize recovered materials. Furthermore, as automotive manufacturers face pressure to reduce their environmental impact, the integration of recovered carbon black into their supply chains is likely to become more prevalent, fostering further market expansion.

Rising Raw Material Costs

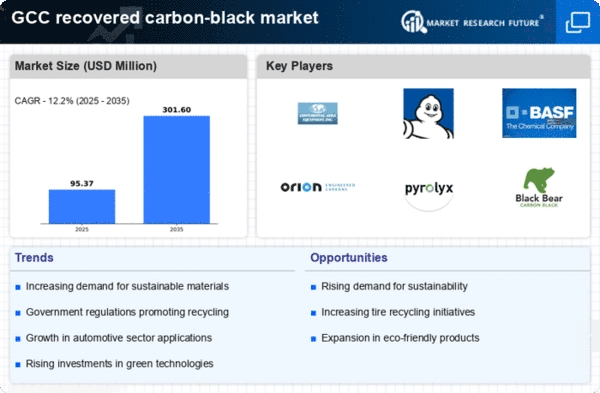

The escalating costs of raw materials for traditional carbon black production are significantly influencing the recovered carbon-black market. As the prices of fossil fuels and other feedstocks continue to rise, manufacturers are increasingly seeking cost-effective alternatives. The recovered carbon-black market presents a compelling solution, as it utilizes waste tires and other rubber products, which are often less expensive than virgin materials. In the GCC, where the demand for rubber products is on the rise, the economic viability of recovered carbon black becomes even more pronounced. Analysts estimate that the market could see a growth rate of around 12% annually as companies look to mitigate raw material costs while adhering to sustainability goals. This economic pressure is likely to drive innovation and investment in recovery technologies, further solidifying the market's position.

Increasing Environmental Awareness

The growing consciousness regarding environmental sustainability is a pivotal driver for the recovered carbon-black market. As consumers and industries alike become more aware of the ecological impacts of traditional carbon black production, there is a marked shift towards sustainable alternatives. This trend is particularly pronounced in the GCC region, where governments are actively promoting green initiatives. The recovered carbon-black market is poised to benefit from this shift, as it offers a viable solution to reduce carbon footprints. In 2025, the demand for recovered carbon black is projected to increase by approximately 15%, driven by both consumer preferences and regulatory frameworks aimed at reducing waste and promoting recycling. This heightened awareness is likely to catalyze investments in recovery technologies, further enhancing the market's growth potential.

Technological Advancements in Recycling

Technological advancements in recycling processes are significantly shaping the landscape of the recovered carbon-black market. Innovations in pyrolysis and other recovery methods are enhancing the efficiency and quality of recovered carbon black, making it a more attractive option for manufacturers. In the GCC, where industrial growth is robust, the demand for high-quality materials is paramount. The recovered carbon-black market is benefiting from these advancements, as they enable producers to meet stringent quality standards while reducing production costs. Recent developments suggest that the efficiency of recovery processes could improve by up to 20% in the coming years, further driving market adoption. As technology continues to evolve, it is likely that the market will see an influx of new players, contributing to increased competition and innovation.

Government Initiatives for Waste Management

Government initiatives aimed at improving waste management practices are a crucial driver for the recovered carbon-black market. In the GCC, authorities are increasingly implementing policies that encourage recycling and the responsible disposal of waste materials, particularly tires. These initiatives not only aim to reduce landfill waste but also promote the circular economy. The recovered carbon-black market stands to gain from these policies, as they create a favorable environment for the adoption of recovery technologies. For instance, the GCC governments have set ambitious targets to recycle at least 50% of waste tires by 2027, which could potentially increase the supply of feedstock for recovered carbon black production. This regulatory support is likely to enhance market growth, with projections indicating a compound annual growth rate (CAGR) of 10% over the next five years.