Growing Emphasis on Cost Efficiency

Cost efficiency is emerging as a critical driver for the network as-a-service market in Indonesia. Organizations are increasingly recognizing the financial benefits of adopting network as-a-service models, which allow them to reduce capital expenditures associated with traditional networking infrastructure. By leveraging subscription-based services, companies can optimize their operational costs while maintaining high-quality network performance. Recent analyses suggest that businesses can save up to 30% on networking costs by transitioning to a network as-a-service model. This financial incentive is likely to propel the adoption of such services, as organizations seek to allocate resources more effectively and enhance their overall profitability in a competitive market.

Increased Focus on Digital Transformation

The ongoing digital transformation across various sectors in Indonesia is significantly impacting the network as-a-service market. As organizations strive to modernize their operations and embrace digital technologies, the demand for robust and scalable networking solutions is intensifying. This transformation is evident in sectors such as finance, retail, and healthcare, where businesses are investing in advanced networking capabilities to support their digital initiatives. Data indicates that approximately 70% of Indonesian companies are prioritizing digital transformation strategies, which inherently require reliable network infrastructure. Consequently, the network as-a-service market is likely to benefit from this trend, as companies seek to implement solutions that facilitate seamless connectivity and data exchange.

Expansion of Internet Connectivity Initiatives

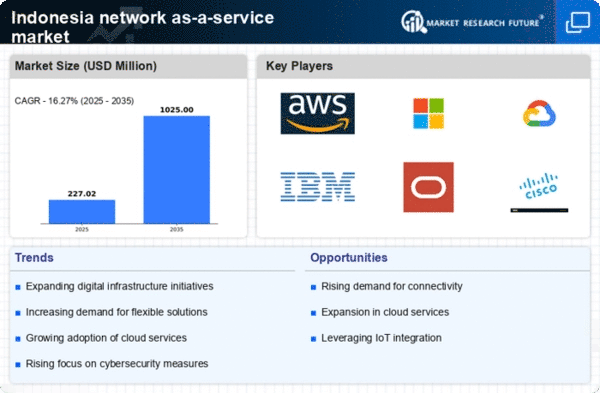

In Indonesia, the expansion of internet connectivity initiatives is significantly influencing the network as-a-service market. Government efforts to enhance digital infrastructure, particularly in rural and underserved areas, are paving the way for increased internet access. Recent statistics indicate that internet penetration in Indonesia has reached approximately 75%, with ongoing projects aimed at further increasing this figure. This expansion not only facilitates greater access to digital services but also drives demand for network as-a-service solutions that can efficiently manage increased traffic and connectivity needs. Consequently, the network as-a-service market is poised for growth as more users gain access to reliable internet services, necessitating advanced networking capabilities to support their activities.

Emergence of Innovative Networking Technologies

The emergence of innovative networking technologies is reshaping the landscape of the network as-a-service market in Indonesia. Advancements in technologies such as software-defined networking (SDN) and network function virtualization (NFV) are enabling organizations to deploy more efficient and flexible networking solutions. These technologies allow for greater automation and management of network resources, which is particularly beneficial for businesses looking to enhance their operational efficiency. As Indonesian enterprises increasingly adopt these innovations, the network as-a-service market is expected to expand, driven by the need for modernized networking capabilities that can support complex business requirements. The integration of such technologies may also lead to improved service delivery and customer satisfaction.

Rising Demand for Flexible Networking Solutions

The network as-a-service market in Indonesia is experiencing a notable surge in demand for flexible networking solutions. Businesses are increasingly seeking to adapt their network infrastructure to meet dynamic operational needs. This shift is driven by the necessity for scalability and agility in a rapidly evolving digital landscape. According to recent data, approximately 60% of Indonesian enterprises are prioritizing flexible networking options to enhance their operational efficiency. The ability to quickly scale network resources allows organizations to respond effectively to market changes, thereby fostering innovation and competitiveness. As a result, the network as-a-service market is likely to witness substantial growth, as companies recognize the value of adaptable networking solutions that align with their strategic objectives.