Supportive Government Policies

The Indonesia hot dip galvanizing market is bolstered by supportive government policies aimed at promoting sustainable practices. The government has implemented regulations that encourage the use of environmentally friendly materials, including galvanized steel, which is known for its recyclability and longevity. In 2025, new policies are expected to be introduced that will further incentivize the use of hot dip galvanizing in construction and manufacturing sectors. These policies may include tax breaks and subsidies for companies that utilize galvanized materials, thereby enhancing the market's growth potential and aligning with global sustainability goals.

Expansion of Manufacturing Sector

The expansion of the manufacturing sector in Indonesia is a significant driver for the hot dip galvanizing market. As the country aims to become a manufacturing hub in Southeast Asia, the demand for galvanized steel is expected to rise. In 2025, the manufacturing sector is projected to grow by 7%, with industries such as automotive and machinery increasingly relying on galvanized components for their products. This growth is likely to create a ripple effect, stimulating demand for hot dip galvanizing services and contributing to the overall development of the industry in Indonesia.

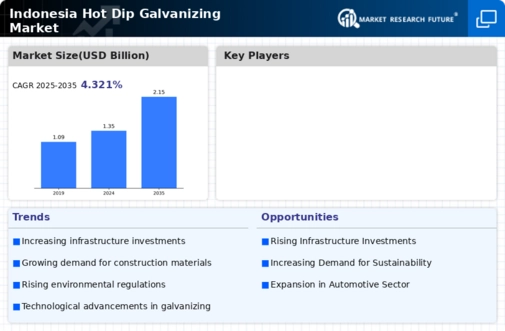

Rising Infrastructure Investments

The Indonesia hot dip galvanizing market is experiencing a surge in demand due to increased investments in infrastructure projects. The government has allocated substantial budgets for the development of roads, bridges, and public facilities, which necessitate the use of galvanized steel to enhance durability and corrosion resistance. In 2025, the Indonesian government announced a plan to invest over USD 400 billion in infrastructure, which is expected to drive the demand for hot dip galvanizing services. This trend indicates a robust growth trajectory for the industry, as galvanized materials are essential for ensuring the longevity of infrastructure in Indonesia's diverse climate conditions.

Technological Innovations in Galvanizing

Technological advancements in the hot dip galvanizing process are playing a crucial role in the Indonesia hot dip galvanizing market. Innovations such as improved coating techniques and automated systems are enhancing the efficiency and quality of galvanizing services. In 2025, it is anticipated that the adoption of advanced technologies will increase, leading to reduced production costs and improved product performance. This shift not only meets the rising demand for high-quality galvanized products but also positions Indonesian manufacturers competitively in the regional market, potentially increasing exports of galvanized materials to neighboring countries.

Growing Awareness of Corrosion Protection

There is a growing awareness among industries in Indonesia regarding the importance of corrosion protection, which is significantly benefiting the hot dip galvanizing market. As sectors such as construction, automotive, and manufacturing expand, the need for materials that can withstand harsh environmental conditions becomes paramount. The Indonesian government has been promoting the use of galvanized steel in various applications, which is reflected in the increasing adoption rates. In 2025, it is estimated that the demand for galvanized products will rise by approximately 15%, driven by this heightened awareness and the need for sustainable building practices.