Emergence of 5G Technology

The rollout of 5G technology in India is anticipated to be a game-changer for the vcsel market. As telecommunications companies invest heavily in 5G infrastructure, the demand for high-speed optical components is likely to increase. Vcsel technology, known for its efficiency in data transmission, is well-suited to support the high bandwidth requirements of 5G networks. The Indian telecom market is projected to grow to $100 billion by 2025, with 5G services playing a crucial role in this expansion. This growth presents a significant opportunity for the vcsel market, as it aligns with the need for advanced optical solutions to facilitate faster and more reliable communication.

Surge in Consumer Electronics

The consumer electronics market in India is experiencing robust growth, driven by rising disposable incomes and a growing middle class. This trend is significantly impacting the vcsel market, as vcsels are increasingly used in various consumer devices, including smartphones, tablets, and smart home products. The market for consumer electronics in India is projected to reach $100 billion by 2025, with a substantial demand for high-speed data transmission and improved device performance. Vcsel technology, with its ability to provide efficient and compact solutions, is likely to play a crucial role in meeting these consumer demands. As manufacturers seek to enhance their product offerings, the vcsel market is expected to witness increased adoption and innovation.

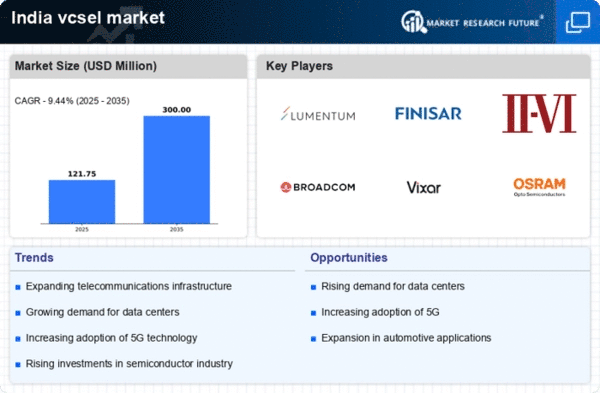

Rising Adoption of Data Centers

The increasing demand for data centers in India is a pivotal driver for the vcsel market. As businesses transition to cloud-based solutions, the need for efficient data transmission and processing escalates. Vcsel technology, known for its high-speed data transfer capabilities, is becoming essential in these facilities. Reports indicate that the data center market in India is projected to grow at a CAGR of approximately 20% from 2023 to 2028. This growth is likely to spur investments in vcsel technology, as companies seek to enhance their infrastructure to support the burgeoning data traffic. Consequently, the vcsel market is poised to benefit significantly from this trend, as more data centers adopt advanced optical technologies to meet their operational demands.

Expansion of Automotive Applications

The automotive sector in India is undergoing a transformation, with a notable shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS). This evolution is driving the demand for high-performance optical components, including vcsels. Vcsel technology is increasingly utilized in LiDAR systems for autonomous vehicles, enhancing safety and navigation capabilities. The Indian automotive market is expected to reach a valuation of $300 billion by 2026, with a substantial portion allocated to innovative technologies. As the vcsel market aligns with these automotive advancements, it stands to gain from the integration of optical solutions in next-generation vehicles, potentially leading to increased market penetration and revenue growth.

Government Initiatives for Digital Transformation

The Indian government is actively promoting digital transformation across various sectors, which is likely to bolster the vcsel market. Initiatives such as Digital India aim to enhance connectivity and technological infrastructure, creating a conducive environment for the adoption of advanced optical technologies. The government's focus on improving internet access and digital services is expected to drive demand for high-speed data transmission solutions, where vcsel technology excels. With investments in smart cities and digital infrastructure, the vcsel market may see a surge in opportunities as public and private sectors collaborate to implement cutting-edge technologies that facilitate seamless communication and data exchange.