Culinary Tourism Growth

Culinary tourism is emerging as a significant driver within the India travel and tourism market, as travelers increasingly seek authentic food experiences. The diverse culinary landscape of India, characterized by regional specialties and traditional cooking methods, attracts food enthusiasts from around the globe. In 2025, culinary tourism contributed approximately 20% to the overall tourism revenue, highlighting its importance. Food festivals, cooking classes, and food tours are becoming popular attractions, encouraging tourists to explore local cuisines. This trend not only enhances the travel experience but also supports local businesses and promotes cultural exchange within the India travel and tourism market.

Growing Domestic Tourism

the India travel and tourism market is experiencing a surge in domestic tourism, driven by an increasing middle-class population and rising disposable incomes. In 2025, domestic tourist arrivals reached over 1.8 billion, reflecting a growing preference for local travel experiences. This trend is further supported by the rise of social media, which encourages individuals to explore lesser-known destinations within India. The government has also promoted regional tourism through various initiatives, such as the Swadesh Darshan scheme, which aims to develop theme-based tourist circuits. This growing domestic tourism landscape presents significant opportunities for the India travel and tourism market.

Adventure and Experiential Tourism

the India travel and tourism market is witnessing a notable shift towards adventure and experiential tourism. With an increasing number of travelers seeking unique experiences, activities such as trekking, river rafting, and wildlife safaris are gaining popularity. The adventure tourism segment is projected to grow at a CAGR of around 15% over the next five years, indicating a strong demand for such experiences. Regions like Himachal Pradesh, Uttarakhand, and Rajasthan are becoming hotspots for adventure tourism, attracting both domestic and international tourists. This trend not only diversifies the offerings within the India travel and tourism market but also contributes to local economies.

Government Initiatives and Policies

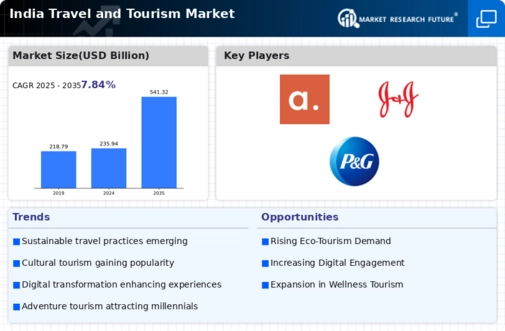

the India travel and tourism market benefits from various government initiatives aimed at promoting tourism. The Ministry of Tourism has launched campaigns such as 'Incredible India' and 'Atithi Devo Bhava' to enhance the country's image as a tourist destination. Additionally, the introduction of e-Visa facilities for citizens of over 160 countries has simplified the travel process, potentially increasing tourist inflow. In 2025, the industry witnessed a growth rate of approximately 10.5%, indicating a robust recovery and expansion. The government's focus on infrastructure development, including the construction of new airports and highways, further supports the growth of the India travel and tourism market.

Digital Transformation in Travel Services

the India travel and tourism market is undergoing a digital transformation, with technology playing a pivotal role in enhancing customer experiences. The rise of online travel agencies (OTAs) and mobile applications has made it easier for travelers to plan and book their trips. In 2025, it is estimated that over 60% of travel bookings in India are made online, reflecting a shift towards digital platforms. Additionally, advancements in artificial intelligence and data analytics are enabling personalized travel experiences, catering to individual preferences. This digital evolution not only streamlines operations but also positions the India travel and tourism market for future growth.