Growing Demand for AI Solutions

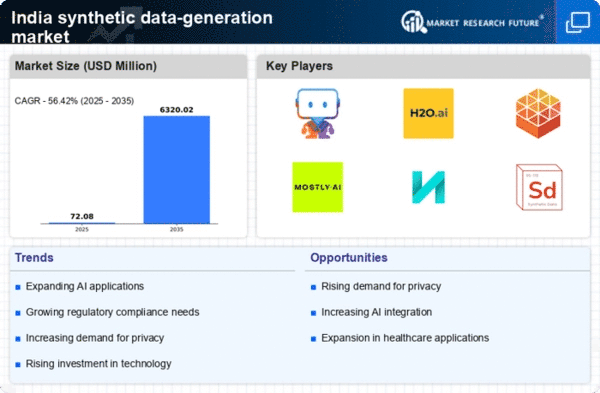

The increasing integration of artificial intelligence (AI) across various sectors in India is driving the synthetic data-generation market. Organizations are increasingly relying on AI for data analysis, predictive modeling, and decision-making processes. This trend necessitates the availability of high-quality, diverse datasets, which synthetic data can provide. The market for AI in India is projected to reach $7.8 billion by 2025, indicating a robust growth trajectory. As businesses seek to enhance their AI capabilities, the demand for synthetic data is likely to rise, thereby propelling the synthetic data-generation market. Furthermore, the ability of synthetic data to mimic real-world scenarios without compromising sensitive information makes it an attractive option for AI developers, further solidifying its role in the synthetic data-generation market.

Increased Focus on Data Security

The rising concerns regarding data security in India are driving the synthetic data-generation market. Organizations are increasingly aware of the risks associated with handling sensitive information, leading to a heightened focus on data protection strategies. Synthetic data provides a solution by allowing organizations to conduct analyses and develop models without exposing real user data. This capability is particularly valuable in sectors such as finance and healthcare, where data breaches can have severe consequences. As businesses prioritize data security, the demand for synthetic data solutions is expected to grow, thereby propelling the synthetic data-generation market. This trend indicates a shift towards more secure data practices, aligning with the broader objectives of safeguarding user privacy.

Expansion of Data-Driven Decision Making

The shift towards data-driven decision-making in Indian enterprises is significantly influencing the synthetic data-generation market. Organizations are increasingly recognizing the value of data in shaping strategies and improving operational efficiency. As a result, there is a growing need for diverse datasets to train machine learning models and conduct analyses. Synthetic data offers a viable solution, as it can be generated in large volumes and tailored to specific requirements. This trend is particularly evident in sectors such as finance and retail, where data analytics plays a crucial role in understanding consumer behavior. this market is likely to expand as businesses invest in data analytics capabilities, seeking to leverage synthetic data for enhanced insights and competitive advantage.

Regulatory Compliance and Data Governance

With the increasing emphasis on data protection regulations in India, organizations are compelled to adopt practices that ensure compliance. The synthetic data-generation market stands to benefit from this trend, as synthetic data can help organizations meet regulatory requirements without exposing real user data. The implementation of the Personal Data Protection Bill is expected to enhance the focus on data governance, thereby increasing the demand for synthetic data solutions. By utilizing synthetic data, companies can conduct analyses and develop models while adhering to legal frameworks, thus mitigating risks associated with data breaches. This compliance-driven approach is likely to stimulate growth in the synthetic data-generation market, as businesses seek to balance innovation with regulatory adherence.

Rising Investment in Research and Development

Investment in research and development (R&D) within the technology sector in India is fostering innovation in the synthetic data-generation market. Companies are increasingly allocating resources to develop advanced synthetic data solutions that can cater to various industry needs. This focus on R&D is expected to lead to the creation of more sophisticated algorithms and tools for generating synthetic data, enhancing its applicability across sectors. The Indian government has also been promoting initiatives to boost technological innovation, which may further encourage investments in synthetic data technologies. As R&D efforts intensify, this market is likely to witness significant advancements, positioning it as a critical component of the broader technology landscape.