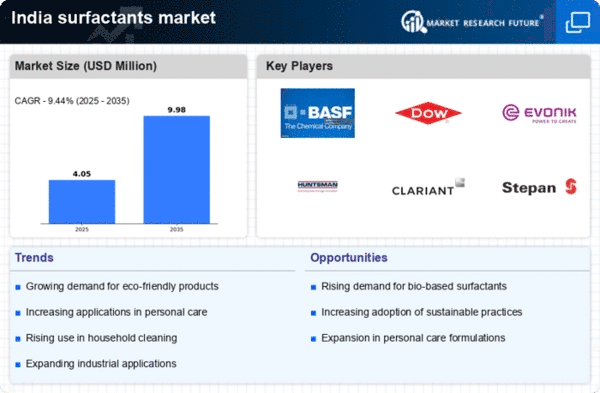

The surfactants market in India is currently experiencing notable growth, driven by various factors including increasing demand from end-use industries such as personal care, household cleaning, and industrial applications. The rising awareness regarding hygiene and cleanliness has led to a surge in the consumption of surfactants, which are essential components in many cleaning products. Additionally, the expanding population and urbanization are contributing to the growth of this market, as more consumers seek effective cleaning solutions. Furthermore, the shift towards eco-friendly and sustainable products is influencing manufacturers to innovate and develop bio-based surfactants, which are perceived as safer alternatives. This trend aligns with the broader global movement towards sustainability, indicating a potential shift in consumer preferences. Moreover, the surfactants market is likely to benefit from advancements in technology and production processes. Innovations in formulation and application techniques are enhancing the efficiency and effectiveness of surfactants, making them more appealing to manufacturers and consumers alike. The government's initiatives to promote manufacturing and reduce import dependency may also play a crucial role in shaping the market landscape. As the industry evolves, it appears that the focus will increasingly be on developing high-performance surfactants that meet stringent regulatory standards while addressing environmental concerns. Overall, the surfactants market in India is poised for continued expansion, driven by both consumer demand and technological advancements.

Shift Towards Bio-based Surfactants

There is a growing trend towards the development and use of bio-based surfactants in the surfactants market. This shift is largely driven by increasing consumer awareness regarding environmental sustainability and the harmful effects of synthetic chemicals. Manufacturers are responding by innovating and formulating products that utilize renewable resources, which are perceived as safer and more eco-friendly alternatives.

Rising Demand from Personal Care Sector

The personal care sector is witnessing a significant increase in demand for surfactants, as consumers seek effective and gentle cleansing products. This trend is fueled by a heightened focus on personal hygiene and grooming, leading to the formulation of new products that incorporate surfactants for improved performance. As a result, manufacturers are likely to invest in research and development to create specialized surfactants tailored for this sector.

Technological Advancements in Production

Technological advancements are playing a crucial role in the surfactants market, particularly in production processes. Innovations in manufacturing techniques are enhancing the efficiency and quality of surfactants, allowing for the development of high-performance products. This trend may lead to increased competitiveness among manufacturers, as they strive to meet evolving consumer demands and regulatory requirements.