Expansion of Data Centers

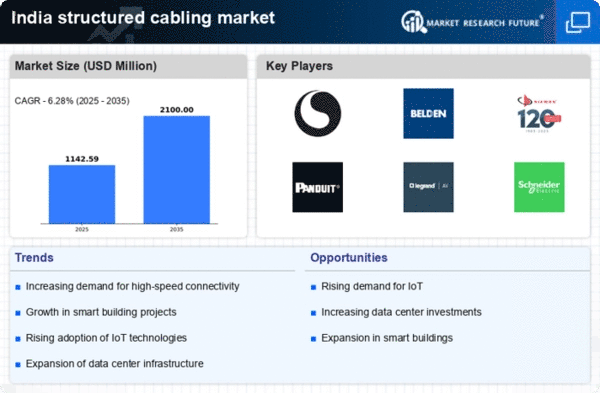

The rapid expansion of data centers in India is a crucial driver for the structured cabling market. As businesses increasingly rely on data-driven solutions, the demand for efficient data management and storage solutions has surged. This trend is reflected in the projected growth of the data center market, which is expected to reach approximately $4.5 billion by 2025. Consequently, the structured cabling market is witnessing heightened demand for advanced cabling solutions that can support high data transfer rates and ensure reliable connectivity. The need for robust infrastructure to accommodate cloud services and big data analytics further propels the growth of structured cabling systems, as organizations seek to enhance their operational efficiency and scalability.

Growth of Smart Buildings

The increasing trend towards smart buildings in India is a notable driver for the structured cabling market. As urbanization accelerates, there is a growing emphasis on integrating technology into building management systems. Smart buildings utilize structured cabling to support various applications, including security, lighting, and HVAC systems. The structured cabling market is likely to see a surge in demand as developers and property owners recognize the benefits of efficient cabling solutions in enhancing building performance and energy efficiency. With the smart building market projected to grow at a CAGR of over 30% in the coming years, the structured cabling market is poised to play a pivotal role in this transformation.

Rising Focus on Network Security

The heightened focus on network security in India is emerging as a significant driver for the structured cabling market. With the increasing frequency of cyber threats, organizations are prioritizing secure and reliable network infrastructures. Structured cabling systems are essential for establishing secure communication channels and ensuring data integrity. The structured cabling market is likely to benefit from this trend as businesses invest in advanced cabling solutions that support robust security measures. As organizations recognize the importance of safeguarding their networks, the demand for structured cabling systems that facilitate secure connectivity is expected to grow, contributing to the overall market expansion.

Increased Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices in India is driving the structured cabling market. As more devices become interconnected, the need for reliable and high-capacity cabling solutions becomes paramount. The structured cabling market is experiencing growth as businesses and households seek to implement IoT technologies for improved efficiency and automation. This trend is supported by the increasing number of smart devices, which is expected to reach over 1 billion by 2025 in India. Consequently, the demand for structured cabling systems that can support the connectivity and data transfer requirements of these devices is likely to rise, further propelling market growth.

Government Initiatives for Digital Infrastructure

Government initiatives aimed at enhancing digital infrastructure in India significantly influence the structured cabling market. Programs such as Digital India and Smart Cities Mission are designed to improve connectivity and promote technological advancements across urban and rural areas. These initiatives are likely to drive investments in structured cabling systems, as they are essential for establishing reliable communication networks. The structured cabling market stands to benefit from increased funding and support for projects that require modern cabling solutions. As the government prioritizes digital transformation, the demand for structured cabling systems is expected to rise, facilitating better connectivity and access to information for citizens.