Rise of Smart Cities

The emergence of smart cities in the GCC region is a crucial driver for the structured cabling market. As urban areas evolve into smart cities, the demand for integrated communication systems increases. These systems rely heavily on structured cabling to facilitate seamless connectivity among various smart technologies, such as traffic management, energy monitoring, and public safety systems. The GCC governments are investing heavily in smart city projects, with an estimated budget of over $100 billion allocated for such initiatives. This investment is likely to create substantial opportunities for the structured cabling market, as infrastructure development requires advanced cabling solutions to support the interconnectedness of smart devices and systems. The market could experience a surge in demand as cities transition towards more intelligent and efficient urban environments.

Expansion of Data Centers

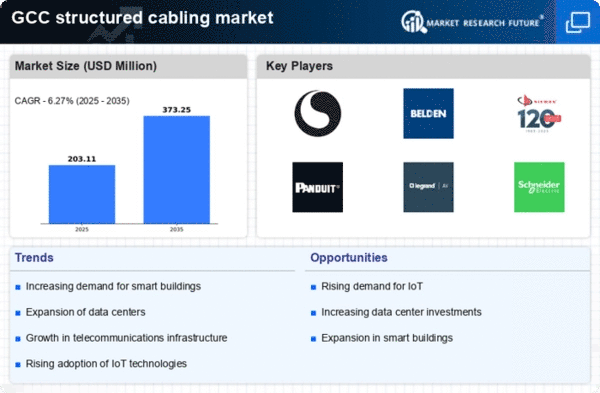

The rapid expansion of data centers in the GCC region is a primary driver for the structured cabling market. As businesses increasingly rely on cloud computing and data storage solutions, the demand for efficient cabling systems rises. In 2025, the data center market in the GCC is projected to reach approximately $3 billion, indicating a robust growth trajectory. This expansion necessitates advanced structured cabling solutions to ensure high-speed data transmission and reliability. Moreover, the increasing number of internet users and the proliferation of IoT devices further amplify the need for sophisticated cabling infrastructure. Consequently, the structured cabling market will benefit significantly from this trend, as companies seek to enhance their operational efficiency and support their digital transformation initiatives.

Increased Focus on Network Security

As cyber threats become more sophisticated, the emphasis on network security is driving the structured cabling market in the GCC. Organizations are increasingly aware of the vulnerabilities associated with outdated cabling systems, which can compromise data integrity and security. Consequently, there is a growing trend towards upgrading to modern structured cabling solutions that offer enhanced security features. The market for network security solutions in the GCC is projected to grow at a CAGR of 12% through 2025, indicating a strong correlation with the structured cabling market. Businesses are likely to invest in advanced cabling systems that support secure data transmission and protect against potential breaches. This heightened focus on security could lead to a significant uptick in demand for structured cabling solutions that meet stringent security standards.

Government Initiatives and Regulations

Government initiatives aimed at enhancing telecommunications infrastructure in the GCC are significantly influencing the structured cabling market. Various national strategies focus on improving connectivity and digital services, which necessitate the implementation of advanced cabling systems. For instance, the UAE Vision 2021 and Saudi Vision 2030 emphasize the importance of robust telecommunications frameworks. These initiatives are expected to drive investments in structured cabling solutions, as businesses and public sectors align with regulatory requirements. The structured cabling market is likely to see increased demand as organizations strive to comply with these regulations while enhancing their network capabilities. This alignment with government policies could potentially lead to a market growth rate of around 10% annually in the coming years.

Technological Advancements in Cabling Solutions

Technological advancements in cabling solutions are reshaping the structured cabling market in the GCC. Innovations such as fiber optic technology and high-speed cabling systems are becoming increasingly prevalent, offering superior performance and reliability. The shift towards fiber optics is particularly noteworthy, as it provides higher bandwidth and faster data transmission rates compared to traditional copper cabling. The structured cabling market is expected to witness a growth rate of approximately 8% annually, driven by these technological advancements. As businesses seek to future-proof their networks, the adoption of cutting-edge cabling solutions is likely to accelerate. This trend not only enhances operational efficiency but also positions organizations to better meet the demands of an increasingly digital landscape.