Rising Geriatric Population

The increasing geriatric population in India is a pivotal driver for the structural heart-devices market. As individuals age, the incidence of cardiovascular diseases tends to rise, necessitating advanced medical interventions. By 2025, it is projected that approximately 10% of India's population will be over 60 years old, leading to a heightened demand for structural heart devices. This demographic shift indicates a growing need for innovative solutions to manage age-related heart conditions. Furthermore, the healthcare infrastructure is adapting to cater to this aging population, which may further stimulate market growth. The market is likely to benefit from this trend, as healthcare providers seek to implement effective treatments for elderly patients suffering from various heart ailments.

Rising Awareness and Education

The growing awareness and education regarding cardiovascular health in India are crucial drivers for the structural heart-devices market. Initiatives by healthcare organizations and government bodies aim to educate the public about heart diseases and available treatment options. As awareness increases, patients are more likely to seek medical advice and treatment, leading to a higher demand for structural heart devices. Furthermore, educational campaigns are likely to emphasize the importance of early detection and intervention, which could result in a surge in procedures involving these devices. This heightened awareness may contribute to a more informed patient population, ultimately benefiting the structural heart-devices market.

Increased Healthcare Expenditure

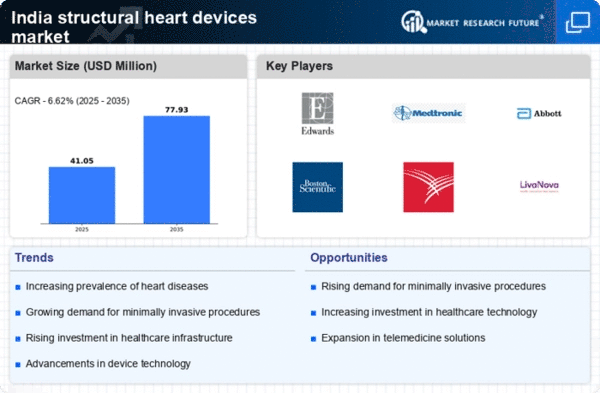

India's rising healthcare expenditure is significantly impacting the structural heart-devices market. With the government and private sectors investing more in healthcare, the overall spending is expected to reach around 3.5% of GDP by 2025. This increase in funding allows for the procurement of advanced medical technologies, including structural heart devices. Hospitals and healthcare facilities are likely to enhance their capabilities, leading to improved patient outcomes. Moreover, as patients become more aware of available treatments, the demand for innovative heart devices is expected to grow. This trend suggests that the structural heart-devices market will experience a positive trajectory, driven by enhanced financial resources allocated to healthcare.

Government Initiatives and Policies

Government initiatives and policies aimed at improving cardiovascular care are likely to bolster the structural heart-devices market. The Indian government has been actively promoting healthcare reforms, including the National Health Mission, which focuses on enhancing access to quality healthcare services. Such initiatives may lead to increased funding for cardiovascular treatments and the adoption of advanced technologies. Additionally, regulatory support for the approval of new devices can expedite their entry into the market. This supportive environment may encourage manufacturers to invest in research and development, ultimately benefiting the structural heart-devices market by providing a wider array of treatment options for patients.

Technological Innovations in Healthcare

Technological innovations in healthcare are transforming the landscape of the structural heart-devices market. Advancements in minimally invasive procedures and device design are enhancing the efficacy and safety of treatments. For instance, the introduction of transcatheter aortic valve replacement (TAVR) has revolutionized the management of aortic stenosis, providing patients with less invasive options. As these technologies continue to evolve, they are likely to attract more patients seeking effective solutions for heart conditions. The structural heart-devices market is expected to thrive as healthcare providers adopt these innovations, leading to improved patient outcomes and increased procedural volumes.