Growing Awareness and Education

The growing awareness of stroke symptoms and the importance of timely treatment is driving the stroke post-processing-software market. Educational campaigns by health organizations and government bodies have increased public knowledge about stroke risk factors and the need for immediate medical attention. This heightened awareness is leading to more patients seeking medical help sooner, which in turn increases the demand for effective diagnostic tools. In India, the number of awareness programs has surged, with a reported increase of 30% in community outreach initiatives over the last year. As more individuals recognize the signs of stroke, healthcare providers are compelled to adopt advanced post-processing software to ensure rapid and accurate diagnosis, thereby propelling market growth.

Rising Incidence of Stroke Cases

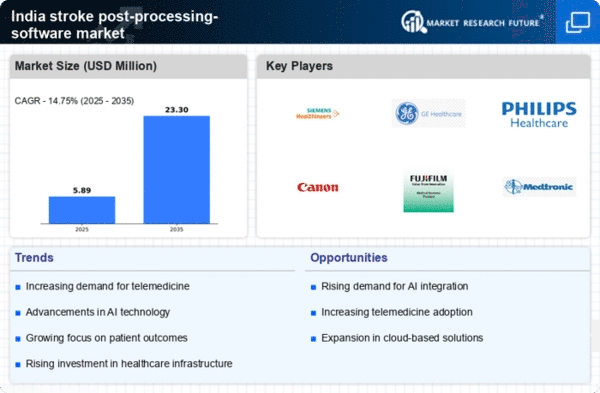

The increasing prevalence of stroke cases in India is a primary driver for the stroke post-processing-software market. According to recent health statistics, stroke is one of the leading causes of morbidity and mortality in the country, with an estimated 1.8 million new cases reported annually. This alarming trend necessitates advanced diagnostic tools and software solutions to enhance patient outcomes. As healthcare providers seek to improve their diagnostic capabilities, the demand for stroke post-processing software is expected to rise significantly. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the urgent need for effective stroke management solutions. Consequently, the stroke post-processing-software market is poised to expand as healthcare facilities invest in technology to address this pressing health challenge.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for stroke management are significantly influencing the stroke post-processing-software market. The Indian government has launched various programs to enhance healthcare delivery, particularly in rural areas where stroke incidence is rising. Increased funding for healthcare facilities has led to the procurement of advanced diagnostic tools, including stroke post-processing software. Reports indicate that public health expenditure in India is expected to reach 2.5% of GDP by 2025, which could further bolster investments in stroke management technologies. As a result, the stroke post-processing-software market is likely to benefit from these initiatives, as healthcare providers seek to comply with new standards and improve patient care.

Technological Advancements in Imaging

Technological innovations in imaging modalities, such as MRI and CT scans, are propelling the stroke post-processing-software market forward. Enhanced imaging techniques provide clearer and more detailed images, which are crucial for accurate diagnosis and treatment planning. The integration of advanced algorithms and software tools allows for better analysis of imaging data, facilitating timely interventions. In India, the adoption of these technologies is on the rise, with a reported increase of 20% in the installation of advanced imaging systems in hospitals over the past two years. This trend indicates a growing recognition of the importance of high-quality imaging in stroke management, thereby driving the demand for specialized post-processing software that can effectively analyze and interpret complex imaging data.

Increased Investment in Healthcare Technology

The surge in investment in healthcare technology is a crucial driver for the stroke post-processing-software market. As hospitals and clinics in India modernize their facilities, there is a growing emphasis on integrating advanced software solutions to enhance diagnostic accuracy and patient care. Recent data suggests that healthcare technology investments in India are projected to reach $10 billion by 2026, reflecting a robust commitment to improving healthcare delivery. This influx of capital is likely to facilitate the adoption of innovative stroke post-processing software, as healthcare providers seek to leverage technology for better patient outcomes. Consequently, the stroke post-processing-software market is expected to thrive as investments in healthcare technology continue to rise.