Increased Healthcare Expenditure

The rising healthcare expenditure in the GCC countries is a significant driver for the stroke post-processing-software market. Governments and private sectors are investing heavily in healthcare infrastructure, aiming to enhance the quality of medical services. In 2025, healthcare spending in the GCC is projected to reach approximately $100 billion, reflecting a commitment to improving health outcomes. This financial support facilitates the acquisition of advanced medical technologies, including stroke post-processing software. As healthcare providers allocate more resources towards innovative solutions, the market is expected to expand, providing opportunities for software developers to introduce cutting-edge products that cater to the evolving needs of healthcare professionals.

Rising Incidence of Stroke Cases

The increasing prevalence of stroke cases in the GCC region is a primary driver for the stroke post-processing-software market. According to health statistics, stroke is one of the leading causes of morbidity and mortality in the region, with an estimated incidence rate of 200 per 100,000 individuals. This alarming trend necessitates advanced diagnostic and treatment solutions, thereby propelling the demand for innovative software that enhances post-stroke care. Healthcare providers are increasingly adopting these technologies to improve patient outcomes and streamline workflows. The stroke post-processing-software market is expected to grow as hospitals and clinics seek to implement effective solutions that can assist in the timely analysis of imaging data, ultimately leading to better management of stroke patients.

Technological Advancements in Imaging

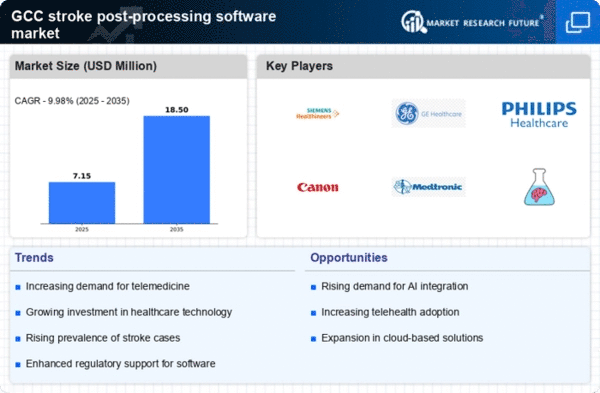

Technological innovations in imaging modalities, such as MRI and CT scans, are significantly influencing the stroke post-processing-software market. Enhanced imaging techniques provide clearer and more detailed images, which are crucial for accurate diagnosis and treatment planning. The integration of advanced algorithms and machine learning capabilities into post-processing software allows for more efficient analysis of imaging data. As healthcare facilities in the GCC invest in state-of-the-art imaging technologies, the demand for compatible post-processing software is likely to increase. This trend indicates a growing market, with projections suggesting a compound annual growth rate (CAGR) of 15% over the next five years, driven by the need for improved diagnostic accuracy and patient care.

Growing Awareness of Stroke Prevention

There is a notable increase in public awareness regarding stroke prevention and management in the GCC region. Educational campaigns and health initiatives are being implemented to inform the population about the risk factors associated with stroke. This heightened awareness is driving demand for effective post-processing software that can assist healthcare providers in identifying at-risk patients and implementing preventive measures. The stroke post-processing-software market is likely to benefit from this trend, as healthcare institutions seek tools that can facilitate early detection and intervention. As a result, the market may experience growth as more facilities adopt software solutions that align with preventive healthcare strategies.

Collaboration Between Healthcare Providers and Tech Companies

The collaboration between healthcare providers and technology companies is emerging as a crucial driver for the stroke post-processing-software market. Partnerships are being formed to develop tailored software solutions that meet the specific needs of healthcare facilities in the GCC. These collaborations often lead to the creation of innovative tools that enhance the efficiency of stroke diagnosis and treatment. As healthcare providers recognize the value of integrating technology into their practices, the demand for specialized post-processing software is expected to rise. This synergy between sectors not only fosters innovation but also contributes to the overall growth of the market, as new solutions are introduced to address the complexities of stroke management.