Expansion of Cloud-Based Solutions

The shift towards cloud-based solutions is transforming the speech analytics market in India. Organizations are increasingly adopting cloud technologies to enhance scalability and flexibility in their operations. This transition allows businesses to access advanced analytics tools without the need for extensive on-premises infrastructure. As of November 2025, it is estimated that over 60% of companies in India are utilizing cloud-based speech analytics solutions. This trend not only reduces operational costs but also facilitates seamless integration with existing systems. Furthermore, the ability to analyze large volumes of data in real-time is becoming a critical factor for organizations aiming to improve customer engagement and operational efficiency. The expansion of cloud-based solutions is expected to play a pivotal role in shaping the future landscape of the speech analytics market.

Growing Demand for Real-Time Insights

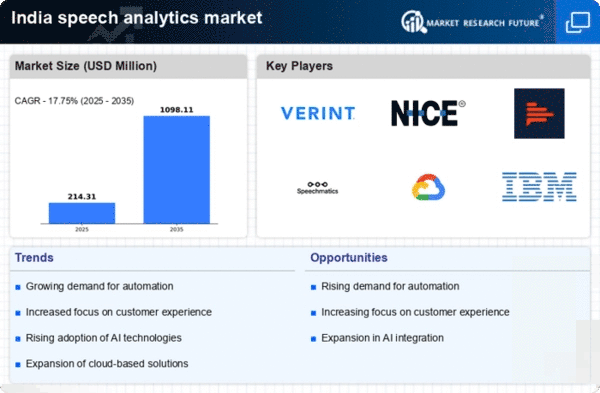

The speech analytics market in India is experiencing a notable surge in demand for real-time insights. Organizations are increasingly recognizing the value of immediate data analysis to enhance decision-making processes. This trend is particularly evident in sectors such as telecommunications and customer service, where timely responses can significantly impact customer satisfaction. According to recent estimates, the market is projected to grow at a CAGR of approximately 20% over the next five years. Companies are investing in advanced speech analytics solutions to capture and analyze customer interactions in real-time, thereby improving operational efficiency and service quality. This growing demand for real-time insights is likely to drive innovation and competition within the speech analytics market, as businesses strive to leverage data for strategic advantages.

Emergence of Advanced Analytics Techniques

The speech analytics market in India is evolving with the emergence of advanced analytics techniques, such as machine learning and natural language processing. These technologies are enabling organizations to derive deeper insights from speech data, enhancing their ability to understand customer behavior and preferences. As businesses increasingly seek to leverage data for competitive advantage, the integration of advanced analytics into speech analytics solutions is becoming essential. It is anticipated that the adoption of these techniques will contribute to a market growth rate of around 18% over the next few years. By harnessing advanced analytics, companies can improve their operational efficiency and customer engagement strategies, thereby driving the overall growth of the speech analytics market.

Increased Focus on Multilingual Capabilities

India's diverse linguistic landscape presents both challenges and opportunities for the speech analytics market. As businesses expand their reach across various regions, the demand for multilingual capabilities in speech analytics solutions is on the rise. Organizations are seeking tools that can accurately process and analyze speech data in multiple languages, including regional dialects. This trend is particularly relevant in sectors such as retail and customer service, where effective communication is essential for customer satisfaction. It is projected that the market for multilingual speech analytics solutions will grow by approximately 25% in the coming years. By addressing the need for multilingual capabilities, companies can enhance their customer interactions and gain valuable insights from a broader audience, thereby driving growth in the speech analytics market.

Rising Investment in Customer Experience Technologies

The speech analytics market in India is witnessing a significant increase in investment aimed at enhancing customer experience technologies. Organizations are recognizing the importance of understanding customer sentiments and preferences through speech data analysis. This investment trend is reflected in the growing adoption of speech analytics tools that provide insights into customer interactions, enabling businesses to tailor their services accordingly. As of November 2025, it is estimated that companies are allocating approximately 15% of their IT budgets to customer experience technologies, including speech analytics. This focus on customer experience is likely to drive the development of more sophisticated analytics solutions, ultimately benefiting the speech analytics market by fostering innovation and improving service delivery.