Cost Efficiency and Scalability

Cost efficiency remains a pivotal driver for the software as-a-service market in India. Organizations are increasingly recognizing the financial advantages of adopting SaaS solutions, which often eliminate the need for substantial upfront investments in hardware and software. Instead, businesses can leverage subscription-based models that allow for predictable budgeting. This model not only reduces capital expenditure but also provides the flexibility to scale services according to demand. As companies grow, they can easily adjust their software usage without the constraints of traditional licensing models. The potential for significant cost savings, estimated at around 30% compared to on-premises solutions, is driving many Indian enterprises to transition to SaaS offerings, thereby propelling the growth of the software as-a-service market.

Increased Focus on Data Analytics

The software as-a-service market in India is witnessing a heightened focus on data analytics capabilities. Organizations are increasingly leveraging SaaS solutions that offer advanced analytics tools to derive actionable insights from their data. This trend is indicative of a broader shift towards data-driven decision-making, which is becoming essential for competitive advantage. The integration of analytics within SaaS platforms allows businesses to monitor performance metrics in real-time, enhancing operational efficiency. As a result, the demand for SaaS products that incorporate robust analytics features is expected to rise, contributing to the overall growth of the software as-a-service market. It is estimated that the analytics segment within SaaS could account for over 20% of the market share in the coming years, reflecting the critical role of data in shaping business strategies.

Regulatory Compliance and Governance

Regulatory compliance is emerging as a significant driver for the software as-a-service market in India. With the increasing complexity of data protection laws and industry regulations, organizations are seeking SaaS solutions that facilitate compliance management. Software providers are responding by incorporating features that help businesses adhere to legal requirements, such as data encryption and audit trails. This focus on compliance not only mitigates risks but also enhances trust among customers and stakeholders. As companies navigate the evolving regulatory landscape, the demand for compliant SaaS solutions is likely to grow, thereby influencing the trajectory of the software as-a-service market. It is anticipated that compliance-related features could become a key differentiator for SaaS providers, further driving market expansion.

Growing Demand for Remote Work Solutions

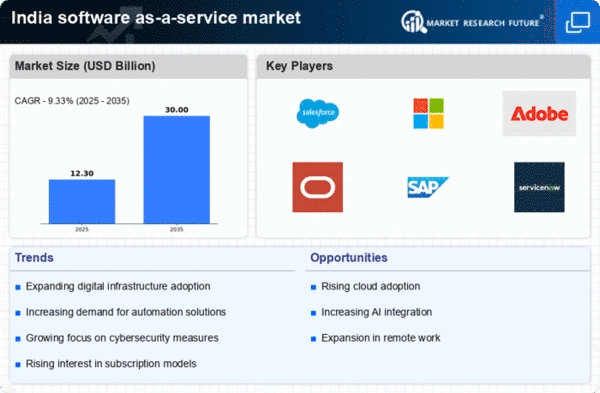

There is a notable surge in demand for remote work solutions in India.. As organizations increasingly adopt flexible work arrangements, the need for cloud-based collaboration tools has intensified. This shift is reflected in the market, which is projected to grow at a CAGR of approximately 25% over the next five years. Companies are seeking solutions that facilitate seamless communication and project management, thereby enhancing productivity. The rise of remote work has prompted businesses to invest in software that supports virtual teams, leading to a robust expansion of the software as-a-service market. Furthermore, the increasing reliance on digital platforms for business operations indicates a long-term trend towards cloud-based solutions, positioning the software as-a-service market as a critical component of modern business infrastructure.

Rising Internet Penetration and Digital Transformation

Rising internet penetration and ongoing digital transformation initiatives significantly influence this market.. As internet access expands, particularly in rural and semi-urban areas, more businesses are becoming aware of the benefits of cloud-based solutions. This increased connectivity is facilitating the adoption of SaaS applications across various sectors, including education, healthcare, and retail. The Indian government’s push for digitalization is also contributing to this trend, as initiatives aimed at enhancing digital infrastructure are being implemented. Consequently, the software as-a-service market is poised for substantial growth, with projections indicating an increase in user adoption rates by over 40% in the next few years. This trend underscores the importance of digital transformation in driving the evolution of the software as-a-service market.