Rising Geriatric Population

India's demographic shift towards an aging population is a crucial factor influencing the softgel capsule market. As the geriatric population continues to grow, there is an increasing need for health supplements that cater to age-related health concerns. Softgel capsules, known for their ease of consumption and enhanced bioavailability, are particularly appealing to older adults. The softgel capsule market is likely to see a substantial increase in demand as this demographic seeks products that support joint health, cognitive function, and overall wellness. Projections indicate that the geriatric population in India will reach approximately 300 million by 2030, creating a significant opportunity for manufacturers to develop targeted softgel formulations. This trend underscores the importance of addressing the specific health needs of older consumers.

Growing Health Consciousness

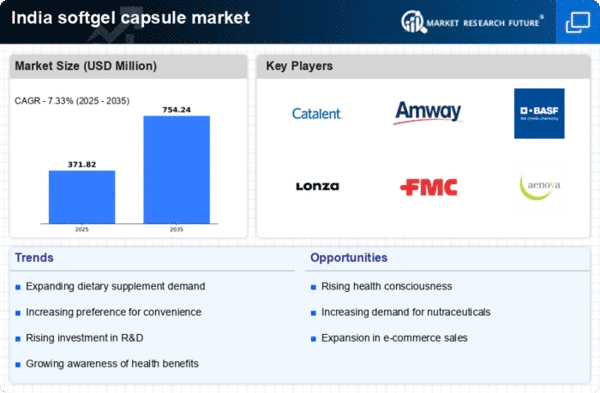

The increasing awareness of health and wellness among the Indian population is a pivotal driver for the softgel capsule market. Consumers are becoming more proactive about their health, leading to a surge in demand for dietary supplements and nutraceuticals. This trend is reflected in the market, where the softgel segment is projected to grow at a CAGR of approximately 8% over the next few years. The softgel capsule market is benefiting from this shift, as these capsules offer a convenient and effective way to deliver essential nutrients. Furthermore, the rise in lifestyle-related health issues has prompted individuals to seek preventive healthcare solutions, further propelling the demand for softgel capsules. As a result, manufacturers are increasingly focusing on developing innovative formulations to cater to this health-conscious demographic.

Innovative Product Development

The softgel capsule market is experiencing a wave of innovation, driven by advancements in formulation technologies and consumer preferences for unique health benefits. Manufacturers are increasingly investing in research and development to create specialized softgel products that cater to specific health needs, such as immune support, digestive health, and beauty from within. This trend is indicative of a broader movement within the softgel capsule market, where differentiation through product innovation is becoming essential for competitive advantage. The introduction of plant-based softgel capsules and those with enhanced absorption capabilities is gaining traction among health-conscious consumers. As a result, the market is likely to witness a proliferation of new products, which could potentially capture a larger share of the health supplement market in India.

Expansion of E-commerce Platforms

The rapid growth of e-commerce in India is significantly impacting the softgel capsule market. With the increasing penetration of the internet and smartphone usage, consumers are now more inclined to purchase health supplements online. This shift is facilitating access to a wider range of products, including softgel capsules, which are often marketed with detailed information about their benefits. The softgel capsule market is witnessing a transformation as online sales channels account for a growing share of total sales, estimated to reach around 30% by 2026. E-commerce platforms provide convenience and competitive pricing, attracting a diverse consumer base. Additionally, the ability to compare products and read reviews enhances consumer confidence, further driving the demand for softgel capsules in the digital marketplace.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare in India is a significant driver for the softgel capsule market. As healthcare costs rise and awareness of preventive measures increases, consumers are more inclined to invest in supplements that promote overall health and well-being. The softgel capsule market is poised to benefit from this trend, as these capsules are often perceived as a proactive approach to health management. With a growing emphasis on maintaining health rather than merely treating illnesses, the demand for softgel capsules is expected to rise. This trend is further supported by government initiatives promoting health awareness and preventive care, which could lead to an increase in the consumption of dietary supplements. Consequently, manufacturers are likely to align their product offerings with this preventive healthcare paradigm.