Innovative Product Development

The softgel capsule market is witnessing a wave of innovative product development, as manufacturers strive to differentiate their offerings in a competitive landscape. This includes the introduction of specialized formulations, such as vegan softgels and those with enhanced absorption capabilities. Recent market analysis suggests that innovation in product formulation could lead to a 15% increase in market share for companies that successfully launch unique products. The softgel capsule market is thus likely to benefit from ongoing research and development efforts, as companies seek to meet evolving consumer preferences and health trends.

Aging Population and Health Needs

The demographic landscape in South Korea is shifting, with a rapidly aging population that is increasingly focused on maintaining health and vitality. This demographic trend is likely to drive the softgel capsule market, as older adults often seek supplements to address specific health concerns such as joint health, cognitive function, and cardiovascular support. According to recent statistics, the population aged 65 and older is expected to reach 20% by 2025, creating a substantial market for health-related products. The softgel capsule market is well-positioned to cater to this demographic, offering targeted formulations that meet the unique needs of older consumers.

Increasing Demand for Nutraceuticals

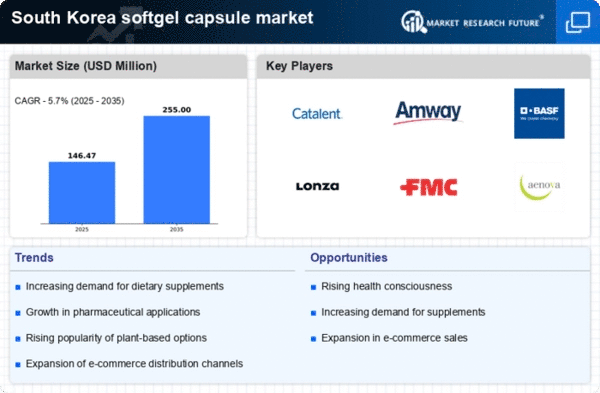

The softgel capsule market in South Korea is experiencing a notable surge in demand for nutraceuticals, driven by a growing awareness of health and wellness among consumers. This trend is reflected in the increasing consumption of dietary supplements, which are often delivered in softgel form due to their ease of use and enhanced bioavailability. Recent data indicates that the nutraceutical sector is projected to grow at a CAGR of approximately 8% over the next five years. As consumers seek convenient and effective ways to incorporate vitamins and minerals into their diets, the softgel capsule market stands to benefit significantly from this shift in consumer behavior.

Focus on Quality and Safety Standards

In South Korea, there is a heightened emphasis on quality and safety standards within the softgel capsule market. Regulatory bodies are implementing stringent guidelines to ensure that health products meet safety and efficacy requirements. This focus on quality is fostering consumer trust and encouraging manufacturers to invest in high-quality ingredients and production processes. As a result, the softgel capsule market is witnessing a shift towards premium products that prioritize safety and transparency. This trend is expected to enhance brand loyalty and drive sales as consumers become more discerning about the supplements they choose.

Rising E-commerce and Online Sales Channels

The softgel capsule market in South Korea is benefiting from the rapid expansion of e-commerce platforms, which provide consumers with convenient access to a wide range of health products. The online retail sector has seen significant growth, with a reported increase of over 30% in online sales of dietary supplements in the past year. This shift towards digital shopping is reshaping consumer purchasing habits, allowing for greater product variety and competitive pricing. As e-commerce continues to thrive, the softgel capsule market is likely to see enhanced distribution channels and increased consumer engagement, further driving market growth.