Government Initiatives and Policies

The India Sickle Cell Disease Market is witnessing a surge in government initiatives aimed at addressing the challenges posed by sickle cell disease. The Indian government has launched various programs to enhance awareness, screening, and treatment facilities across the country. For instance, the National Health Mission has been instrumental in implementing screening programs in tribal areas, where the prevalence of sickle cell disease is notably high. These initiatives not only aim to improve early diagnosis but also facilitate access to treatment, thereby potentially reducing morbidity and mortality rates associated with the disease. Furthermore, the government's commitment to integrating sickle cell disease management into the broader healthcare framework suggests a long-term strategy to combat this genetic disorder, which could significantly impact the India Sickle Cell Disease Market.

Technological Advancements in Treatment

The India Sickle Cell Disease Market is benefiting from technological advancements in treatment options, which are becoming increasingly accessible to patients. Innovations such as gene therapy and novel pharmacological agents are emerging as potential game-changers in the management of sickle cell disease. For instance, recent developments in gene editing technologies, like CRISPR, hold promise for curative approaches that could transform patient outcomes. Additionally, the introduction of new medications aimed at reducing pain crises and improving overall quality of life is enhancing treatment paradigms. As these technologies become more integrated into the healthcare system, they are likely to attract investment and research funding, further propelling the growth of the India Sickle Cell Disease Market. The convergence of technology and healthcare is expected to create a more favorable environment for patients and providers alike.

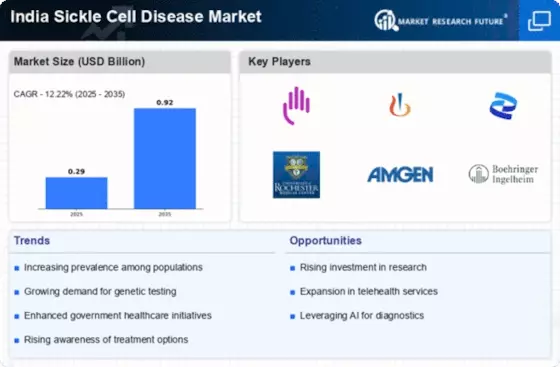

Rising Prevalence of Sickle Cell Disease

The India Sickle Cell Disease Market is significantly influenced by the rising prevalence of sickle cell disease, particularly in certain regions such as Madhya Pradesh, Maharashtra, and Odisha. Reports indicate that approximately 2-3% of the population in these areas is affected by this genetic disorder, leading to an increased demand for healthcare services and treatment options. This growing prevalence is prompting healthcare providers and policymakers to prioritize sickle cell disease management, thereby creating a more robust market environment. The increasing number of patients necessitates the development of specialized treatment centers and the availability of advanced therapies, which could potentially drive market growth. As awareness about the disease continues to spread, the India Sickle Cell Disease Market is likely to expand further, catering to the needs of a larger patient population.

Growing Patient Advocacy and Support Groups

The India Sickle Cell Disease Market is increasingly influenced by the emergence of patient advocacy and support groups, which play a vital role in raising awareness and providing resources for affected individuals. These organizations are instrumental in educating the public about sickle cell disease, promoting early diagnosis, and advocating for better healthcare policies. Their efforts are fostering a supportive community that empowers patients and families to seek timely medical intervention. Additionally, these groups often collaborate with healthcare providers to improve access to treatment and support services, thereby enhancing the overall management of the disease. As the presence of these advocacy groups grows, they are likely to contribute to a more informed patient population, which could positively impact the India Sickle Cell Disease Market.

Increased Focus on Research and Development

The India Sickle Cell Disease Market is experiencing a heightened focus on research and development, which is crucial for advancing treatment options and understanding the disease better. Various academic institutions and pharmaceutical companies are investing in research initiatives aimed at discovering new therapies and improving existing ones. This investment is likely to lead to the development of innovative treatment modalities that could significantly enhance patient care. Moreover, collaborations between public and private sectors are fostering an environment conducive to research, which may yield breakthroughs in the management of sickle cell disease. As the body of knowledge surrounding the disease expands, it is anticipated that the India Sickle Cell Disease Market will evolve, offering more effective solutions to patients and healthcare providers.