Regulatory Compliance and Standards

The service lifecycle-management market in India is significantly influenced by the need for regulatory compliance and adherence to industry standards. Organizations are increasingly required to comply with various regulations that govern service delivery, data protection, and quality assurance. This compliance necessitates the adoption of robust service lifecycle-management solutions that can ensure adherence to these regulations. As a result, companies are investing in technologies that facilitate compliance tracking and reporting, thereby driving growth in the service lifecycle-management market. The market is expected to expand as businesses prioritize compliance to mitigate risks and enhance their operational credibility.

Growing Focus on Customer Experience

In the service lifecycle-management market, there is an increasing emphasis on enhancing customer experience. Companies are recognizing that delivering exceptional service is vital for retaining customers and gaining a competitive edge. This focus on customer experience is prompting organizations to invest in service lifecycle-management solutions that provide personalized and responsive service. As per industry reports, businesses that prioritize customer experience see a 10-15% increase in customer retention rates. This trend is likely to propel the service lifecycle-management market forward, as companies seek to implement strategies that align with customer expectations and foster long-term loyalty.

Increased Investment in Digital Transformation

The ongoing digital transformation across industries is a pivotal driver for the service lifecycle-management market in India. Organizations are allocating substantial budgets towards digital initiatives aimed at modernizing their service delivery processes. This investment is often directed towards implementing advanced service lifecycle-management systems that leverage automation and data analytics. Reports indicate that companies are expected to increase their spending on digital transformation by over 20% in the coming years. This trend not only enhances operational efficiency but also positions businesses to respond swiftly to market changes, thereby propelling the service lifecycle-management market towards sustained growth.

Rising Demand for Efficient Service Management

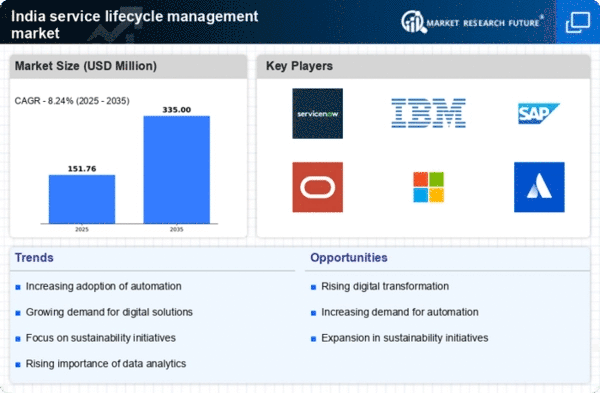

In India, the service lifecycle-management market is experiencing a notable surge in demand for efficient service management solutions. Organizations are increasingly recognizing the need to streamline their service processes to enhance customer satisfaction and operational efficiency. This trend is driven by the growing competition across various sectors, compelling businesses to adopt advanced service lifecycle-management tools. According to recent estimates, the market is projected to grow at a CAGR of approximately 12% over the next five years. Companies are investing in technologies that facilitate better service delivery, thereby improving their market positioning. As a result, the service lifecycle-management market is likely to witness significant growth, as businesses strive to optimize their service offerings and meet evolving customer expectations.

Technological Advancements in Service Delivery

Technological advancements play a crucial role in shaping the service lifecycle-management market in India. The integration of innovative technologies such as cloud computing, IoT, and big data analytics is transforming how services are managed and delivered. These technologies enable organizations to gather and analyze vast amounts of data, leading to improved decision-making and enhanced service quality. The market is expected to reach a valuation of approximately $1 billion by 2026, driven by the adoption of these technologies. Furthermore, the ability to automate service processes reduces operational costs and increases efficiency, making it a key driver for businesses looking to enhance their service lifecycle-management capabilities.