Market Share

India Seed Grain Cleaning Grading Machine Market Share Analysis

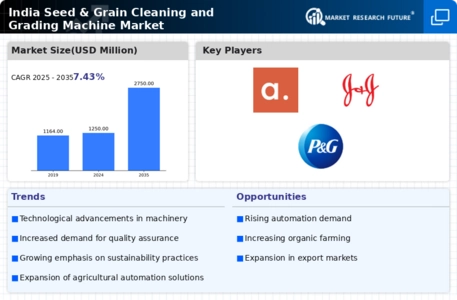

Notably, in the vibrant Indian market for seed grain cleaning and grading machine, many companies use a variety of market share positioning strategies to maintain their competitive advantage. These approaches are focused on establishing a unique identity, knowing the customer requirements and also optimizing the usage of resources. One common strategy is the differentiation, where firms strive to provide distinct features or a better quality than rivals. This makes it possible for them to establish market niches and target the clients who value particular attributes in processing seed grain. One of the main tactics involves cost leadership, whereby companies seek to be a low-cost producers in that market. Through improved operational effectiveness, efficient processes, and strategic supplier negotiations the companies are able to achieve competitive prices that attract price conscious customers. This strategy is especially efficient for a market where the cost issue significantly impacts the buyers’ choices, and businesses can acquire an appreciative part of this market through selling less expensive but high quality products. Market segmentation is another key strategy, whereby the companies customize their products to develop customer-centric offerings. This knowledge of the unique demands from farmers and agricultural businesses across several regions enables firms to design tailored solutions. For example, a company could specialise its seed grain cleaning and grading machines for the crops prevalent in one region thus; tune more effectively to the local customers. Market share positioning is equally supplemented through the collaborations and partnerships. Firms may partner with agricultural research organizations, government agencies or other industry partners in order to improve their technological strengths and reach a larger customer pools as well as overcome regulatory hurdles. These types of partnerships not only improve the overall development of the sector but also enhance the companies’ position in terms of market relevance. Furthermore, innovation marks a very common theme in the successful market share positioning strategies. Continuous R&D is facilitating the companies to stay up-to date, introducing advanced technologies able to meet the requirements of modern customers. This may include the incorporation of artificial intelligence, machine learning or also IoT features into seed grain cleaning and grading machines for better quality processing. In addition, a marketing and branding plan should be implemented to facilitate an very effective market presence. Companies spend alot of money on brand equity, conveying their value proposition very efficiently and also developing Brand perceptions that really appeal to its target population. There is a way in which an effective marketing plan does not only attract the new customers but also helps to retain the existing ones, thereby encouraging brand loyalty and trust. Finally, the market share positioning strategies used by the companies in India’s seed grain cleaning and grading machine industry vary significantly from one company to another. However, with differentiation strategies like cost leadership, market segmentation collaborations innovativeness and effective branding companies aim to win a substantial stake in the whole market. With respect to the changing nature of agricultural landscape, adaptability and customer-centricity will remain fundamental in developing success for businesses operating within this field.

Leave a Comment