Government Initiatives and Support

The Indian government plays a pivotal role in promoting the robot software market through various initiatives aimed at enhancing technological adoption. Programs such as 'Make in India' and 'Digital India' encourage the development and deployment of robotics and automation technologies. Financial incentives and grants are provided to companies investing in robot software solutions, which stimulates innovation and growth. The government's focus on increasing the manufacturing output to $1 trillion by 2025 further emphasizes the importance of automation. This supportive environment is likely to attract investments in the robot software market, fostering a robust ecosystem for development and deployment of advanced robotic solutions.

Advancements in Robotics Technology

Technological advancements in robotics are a key driver for the robot software market in India. Innovations in artificial intelligence, machine learning, and sensor technologies are enabling the development of more sophisticated robotic systems. These advancements allow robots to perform complex tasks autonomously, which is increasingly appealing to various industries. The integration of AI-driven software enhances the capabilities of robots, making them more adaptable and efficient. As industries recognize the potential of these technologies, the demand for advanced robot software solutions is likely to rise, indicating a dynamic growth trajectory for the market.

Increasing Focus on Safety and Compliance

The robot software market in India is also influenced by the growing emphasis on safety and compliance within industrial environments. As companies adopt robotic solutions, ensuring the safety of human workers becomes paramount. Regulatory bodies are establishing stringent guidelines for the deployment of robots in workplaces, which necessitates the development of software that adheres to these standards. This focus on safety not only protects employees but also enhances operational efficiency. Companies investing in robot software that prioritizes safety features are likely to gain a competitive edge, thereby driving growth in the market.

Growth of E-commerce and Logistics Sectors

The rapid expansion of the e-commerce and logistics sectors in India significantly impacts the robot software market. With the increasing demand for efficient supply chain management and order fulfillment, companies are turning to robotic solutions to streamline operations. The e-commerce sector is expected to reach $200 billion by 2026, which could lead to a substantial increase in the adoption of robot software for warehousing and delivery processes. Automated systems powered by advanced software can enhance accuracy and speed, addressing the challenges posed by high order volumes. This trend suggests a promising future for the robot software market as businesses seek to optimize their logistics operations.

Rising Demand for Automation in Manufacturing

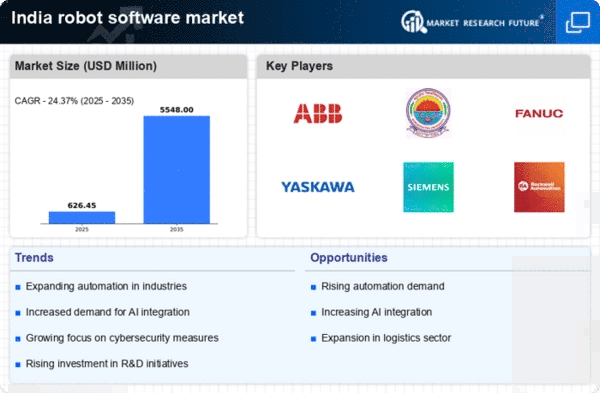

The robot software market in India experiences a notable surge in demand driven by the increasing need for automation in manufacturing processes. Industries are increasingly adopting robotic solutions to enhance productivity and efficiency. According to recent data, the manufacturing sector in India is projected to grow at a CAGR of 10.5% from 2023 to 2028, which is likely to propel the demand for advanced robot software solutions. This trend indicates a shift towards smart manufacturing, where robots equipped with sophisticated software can perform complex tasks with precision. As companies seek to reduce operational costs and improve quality, the integration of robot software becomes essential, thereby fostering growth in the market.