Surge in Healthcare Expenditure

India's healthcare expenditure has been on an upward trajectory, which significantly impacts the robot assisted-surgical-systems market. With the government aiming to increase healthcare spending to 2.5% of GDP by 2025, there is a notable increase in funding for advanced medical technologies. This financial commitment is likely to facilitate the acquisition of robotic surgical systems in hospitals, particularly in urban areas where healthcare facilities are expanding. The robot assisted-surgical-systems market is expected to see a substantial boost as hospitals upgrade their surgical capabilities to improve patient outcomes and operational efficiency, potentially leading to a market growth of around 20% over the next few years.

Growing Awareness and Acceptance Among Surgeons

The growing awareness and acceptance of robotic-assisted surgeries among surgeons is a pivotal driver for the robot assisted-surgical-systems market. As more medical professionals undergo training in robotic techniques, the proficiency and confidence in utilizing these systems increase. This trend is particularly pronounced in India, where surgical training programs are incorporating robotic systems into their curricula. The result is a more skilled workforce that is likely to adopt these technologies in their practice. Consequently, the robot assisted-surgical-systems market is poised for growth, as the number of procedures performed using robotic assistance is expected to rise significantly, potentially doubling in the next five years.

Rising Demand for Minimally Invasive Procedures

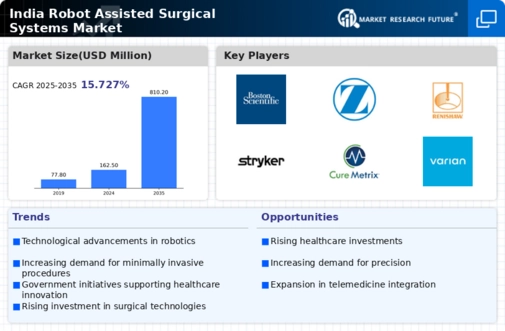

The increasing preference for minimally invasive surgical techniques is a key driver for the robot assisted-surgical-systems market. Patients are increasingly seeking procedures that promise reduced recovery times, less postoperative pain, and minimal scarring. This trend is evident in India, where the demand for such surgeries has surged, leading to a projected growth rate of approximately 15% annually in the sector. Hospitals are responding by investing in advanced robotic systems to meet patient expectations. The robot assisted-surgical-systems market is thus positioned to benefit from this shift, as these systems are designed to enhance precision and control during surgeries, aligning with the growing trend of patient-centric care.

Increased Investment in Healthcare Infrastructure

The Indian government's focus on enhancing healthcare infrastructure is a significant driver for the robot assisted-surgical-systems market. Initiatives aimed at modernizing hospitals and healthcare facilities are leading to increased investments in advanced surgical technologies. The establishment of new hospitals and the upgrading of existing ones are creating opportunities for the integration of robotic systems. This trend is likely to result in a more competitive landscape, with hospitals striving to offer cutting-edge surgical options. As a result, the robot assisted-surgical-systems market is anticipated to expand, with projections indicating a growth rate of approximately 18% in the coming years, driven by infrastructure development.

Technological Innovations and Product Development

Technological innovations in robotic systems are driving the evolution of the robot assisted-surgical-systems market. Continuous advancements in robotics, artificial intelligence, and imaging technologies are enhancing the capabilities of surgical robots. In India, manufacturers are increasingly focusing on developing cost-effective and user-friendly robotic systems tailored to local needs. This innovation is likely to make robotic surgeries more accessible to a broader range of healthcare facilities, including smaller hospitals. As these technologies become more sophisticated and affordable, the robot assisted-surgical-systems market is expected to experience robust growth, with an estimated increase of 25% in market size over the next few years.