Collaborations and Partnerships

Collaborations between academic institutions, research organizations, and private companies are emerging as a key driver for the regenerative medicine market. These partnerships facilitate knowledge exchange and resource sharing, accelerating the development of innovative therapies. Notably, several Indian universities are establishing research collaborations with international institutions to enhance their capabilities in regenerative medicine. Such alliances are expected to lead to breakthroughs in treatment methodologies and clinical applications. The regenerative medicine market is likely to benefit from these collaborative efforts, as they foster a conducive environment for research and development, ultimately enhancing patient care.

Growing Awareness and Acceptance

There is a notable increase in awareness and acceptance of regenerative medicine among healthcare professionals and patients in India. Educational initiatives and outreach programs are contributing to a better understanding of the benefits and applications of regenerative therapies. This shift in perception is crucial, as it encourages patients to seek advanced treatment options, thereby expanding the market. Surveys indicate that over 70% of healthcare providers are now familiar with regenerative medicine concepts, which is likely to enhance patient referrals and adoption rates. As awareness continues to grow, the regenerative medicine market is expected to experience substantial growth.

Government Initiatives and Funding

The Indian government is actively promoting the regenerative medicine market through various initiatives and funding programs. Policies aimed at enhancing healthcare infrastructure and supporting biopharmaceutical research are being implemented. For instance, the Biotechnology Industry Research Assistance Council (BIRAC) has launched schemes to provide financial assistance to startups and researchers in the regenerative medicine sector. This governmental support is crucial for fostering innovation and attracting private investments. With an estimated funding increase of 25% in the biotechnology sector, the regenerative medicine market is poised for accelerated growth, driven by enhanced research capabilities and product development.

Rising Prevalence of Chronic Diseases

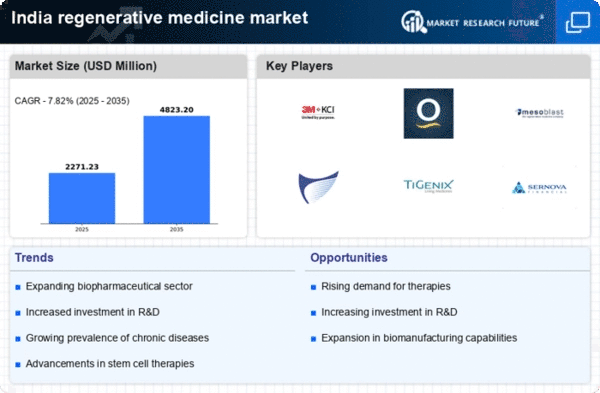

The increasing incidence of chronic diseases in India is a pivotal driver for the regenerative medicine market. Conditions such as diabetes, cardiovascular diseases, and neurodegenerative disorders are on the rise, necessitating innovative treatment solutions. According to recent estimates, chronic diseases account for approximately 60% of all deaths in India, highlighting the urgent need for advanced therapeutic options. Regenerative medicine offers potential solutions through cell therapies and tissue engineering, which could significantly improve patient outcomes. The growing burden of these diseases is likely to propel investments in research and development, thereby fostering growth in the regenerative medicine market.

Technological Innovations in Healthcare

Technological advancements in healthcare are significantly influencing the regenerative medicine market in India. Innovations such as 3D bioprinting, gene editing, and stem cell research are paving the way for novel therapeutic approaches. The integration of artificial intelligence and machine learning in research processes is also enhancing the efficiency of drug development and patient care. As these technologies evolve, they are likely to reduce costs and improve the accessibility of regenerative therapies. The market is projected to grow at a CAGR of 15% over the next five years, driven by these technological innovations that are reshaping treatment paradigms.