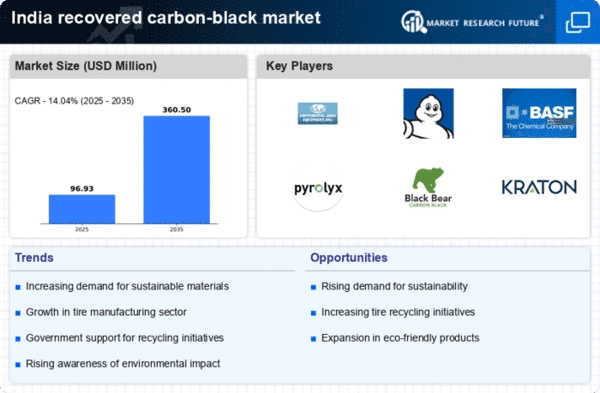

The recovered carbon-black market in India is characterized by a dynamic competitive landscape, driven by increasing demand for sustainable materials and stringent environmental regulations. Key players are actively pursuing strategies that emphasize innovation, regional expansion, and partnerships to enhance their market positioning. For instance, in October 2025, Michelin (FR) announced a collaboration with a local Indian startup to develop advanced recycling technologies, which underscores its commitment to sustainability and innovation in the sector. Similarly, BASF SE (DE) has been focusing on enhancing its production capabilities through strategic investments in local facilities, thereby aiming to optimize its supply chain and reduce operational costs.The market structure appears moderately fragmented, with several players vying for market share. Companies are increasingly localizing their manufacturing processes to better serve regional markets and optimize logistics. This tactic not only reduces lead times but also aligns with the growing trend of sustainability, as localized production often results in lower carbon footprints. The collective influence of these key players shapes a competitive environment where innovation and operational efficiency are paramount.

In September Pyrolyx AG (DE) expanded its operations in India by opening a new facility dedicated to the production of recovered carbon black. This strategic move is expected to significantly increase its production capacity and cater to the rising demand from the automotive and tire industries. The establishment of this facility not only enhances Pyrolyx's market presence but also reflects its commitment to meeting local demand while adhering to sustainability goals.

In August Black Bear Carbon (NL) entered into a joint venture with an Indian tire manufacturer to develop a closed-loop recycling system. This partnership is particularly noteworthy as it aims to create a sustainable supply chain for recovered carbon black, thereby reducing waste and promoting circular economy principles. The strategic importance of this venture lies in its potential to set a benchmark for sustainable practices within the industry, aligning with global trends towards environmental responsibility.

As of November the competitive trends in the recovered carbon-black market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing their competitive edge. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future differentiation will hinge on the ability to adapt to these evolving market dynamics.