Increased Focus on Cybersecurity

As the quantum computing market evolves, there is a heightened focus on cybersecurity, which is becoming a critical driver for the industry. Quantum computing has the potential to disrupt traditional encryption methods, prompting organizations to seek quantum-resistant solutions. In 2025, the market for quantum cybersecurity solutions is projected to grow significantly, potentially reaching $500 million. This growth is indicative of the urgent need for secure communication channels in an increasingly digital world. Companies are investing in quantum-safe cryptography to safeguard sensitive data, thereby creating a robust demand for quantum technologies. The emphasis on cybersecurity not only enhances the resilience of the quantum computing market but also positions India as a leader in developing secure quantum solutions.

Investment in Research and Development

The quantum computing market in India is experiencing a surge in investment directed towards research and development. The government, alongside private enterprises, is allocating substantial funds to foster innovation in quantum technologies. In 2025, it is estimated that R&D spending in this sector could reach approximately $1 billion, reflecting a commitment to advancing quantum computing capabilities. This influx of capital is likely to enhance the development of quantum algorithms and hardware, positioning India as a competitive player in the global landscape. Furthermore, the focus on R&D is expected to create a skilled workforce, essential for sustaining growth in the quantum computing market. As a result, the industry may witness accelerated advancements, leading to practical applications across various sectors, including finance, healthcare, and logistics.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are emerging as a pivotal driver for the quantum computing market in India. Various stakeholders, including academic institutions, research organizations, and technology firms, are joining forces to leverage their expertise and resources. These collaborations are expected to facilitate knowledge sharing and accelerate the development of quantum technologies. In 2025, it is anticipated that the number of partnerships in this sector could increase by over 40%, reflecting a growing recognition of the importance of collective efforts. Such alliances may lead to breakthroughs in quantum algorithms and hardware, enhancing the overall capabilities of the quantum computing market. Additionally, these partnerships could foster a vibrant ecosystem that supports startups and innovation, further enriching the industry landscape.

Educational Initiatives and Skill Development

Educational initiatives and skill development programs are crucial drivers for the quantum computing market in India. Recognizing the need for a skilled workforce, various institutions are introducing specialized courses and training programs focused on quantum technologies. By 2025, it is expected that enrollment in quantum computing-related courses could increase by over 50%, reflecting a growing interest among students and professionals. This emphasis on education is likely to cultivate a talent pool equipped with the necessary skills to advance the quantum computing market. Furthermore, collaborations between academia and industry are fostering practical training opportunities, ensuring that graduates are well-prepared to meet the demands of this evolving field. As a result, the industry may benefit from a continuous influx of innovative ideas and solutions.

Growing Demand for Advanced Computing Solutions

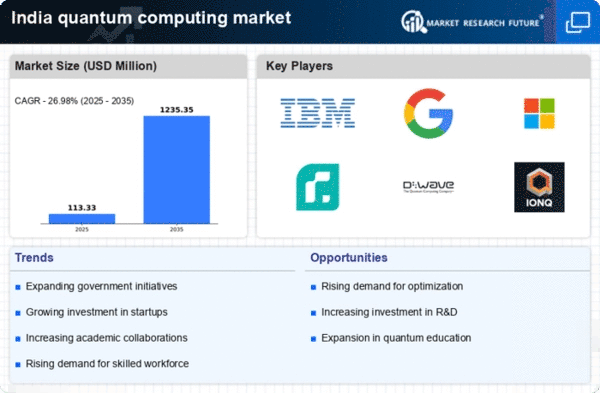

The increasing complexity of computational problems across industries is driving demand for advanced computing solutions, thereby impacting the quantum computing market. Traditional computing systems often struggle with tasks such as optimization and simulation, which are critical in sectors like pharmaceuticals and finance. In 2025, the market is projected to grow at a CAGR of around 30%, indicating a robust interest in quantum technologies. This demand is fueled by the need for faster processing capabilities and the ability to solve problems that are currently intractable. As organizations recognize the potential of quantum computing to revolutionize their operations, investments in this technology are likely to escalate, further propelling the growth of the quantum computing market in India.