India Paper Impregnation Additives Market Summary

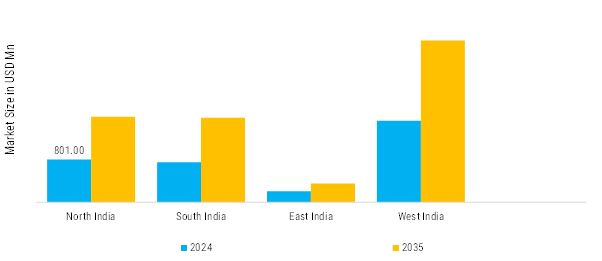

As per Market Research Future analysis, the India Paper Impregnation Additives Market Market Size was estimated at 3,287.4 USD Million in 2024. The India Paper Impregnation Additives industry is projected to grow from 3,466.7 USD Million in 2025 to 6,571.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.6% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The India Paper Impregnation Additives Market is experiencing steady growth driven by rising demand from the decorative laminates, engineered wood, electrical insulation, and specialty packaging industries.

- The market is witnessing increased adoption of formaldehyde-free and low-VOC additives, driven by stricter environmental regulations and rising indoor air quality concerns.

- Demand for food-contact and specialty packaging additives is rising, supported by FSSAI regulations and the shift toward paper-based, sustainable packaging.

- Product innovation and customization are increasing, with focus on bio-based, waterborne, and multifunctional impregnation additives.

- Strategic acquisitions and capacity expansions are strengthening market presence and technological capabilities of key players.

Market Size & Forecast

| 2024 Market Size | 3,287.4 (USD Million) |

| 2035 Market Size | 6,571.0 (USD Million) |

| CAGR (2025 - 2035) | 6.6% |

Major Players

Wiz Chemicals, Wurtz, Additek Sas, Fusoni Chemicals, TAG Chemicals GmbH, Harmony Additives Private Limited, Aeon Chemtech.