Growing Geriatric Population

The demographic shift towards an aging population in India is a crucial driver for the pain relief-medication market. As individuals age, they are more susceptible to various health issues, including chronic pain conditions. The geriatric population is projected to reach approximately 300 million by 2030, which will likely increase the demand for pain relief medications. This demographic trend necessitates the development of tailored pain management solutions that address the unique needs of older adults. Consequently, pharmaceutical companies are focusing on creating medications that are safe and effective for this age group, thereby expanding the pain relief-medication market.

Rising Awareness of Pain Management

There is a notable increase in awareness regarding pain management strategies among the Indian population. Educational campaigns and healthcare initiatives are emphasizing the importance of addressing pain effectively, which is likely to drive the pain relief-medication market. Patients are becoming more informed about their treatment options, leading to a higher demand for effective pain relief solutions. This awareness is further supported by the growing number of healthcare professionals advocating for comprehensive pain management approaches. As a result, the market is witnessing a shift towards more effective and targeted pain relief medications, which could potentially enhance patient outcomes and satisfaction.

Increasing Incidence of Chronic Pain

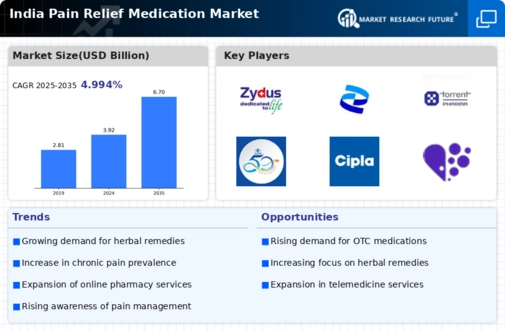

The rising prevalence of chronic pain conditions in India is a primary driver for the pain relief-medication market. Conditions such as arthritis, back pain, and neuropathic pain are becoming more common, affecting a significant portion of the population. According to recent health surveys, approximately 15-20% of adults in India report experiencing chronic pain, which necessitates effective pain management solutions. This growing patient base is likely to increase the demand for various pain relief medications, including both prescription and over-the-counter options. As healthcare providers focus on improving quality of life for patients suffering from chronic pain, the pain relief-medication market is expected to expand, with innovative products being developed to address diverse pain management needs.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are significantly impacting the pain relief-medication market. The development of new analgesics and formulations that offer improved efficacy and safety profiles is likely to attract both healthcare providers and patients. Research into alternative pain relief methods, such as biologics and gene therapy, is also gaining traction. The Indian pharmaceutical industry is increasingly investing in research and development, with the aim of creating novel pain relief medications that cater to the specific needs of the population. This focus on innovation may lead to a broader range of options available in the market, ultimately enhancing the overall landscape of pain management.

Regulatory Support for Pain Management Solutions

The Indian government is increasingly recognizing the importance of effective pain management, leading to supportive regulatory frameworks for the pain relief-medication market. Initiatives aimed at improving access to pain relief medications, including the inclusion of essential analgesics in national health programs, are being implemented. This regulatory support is likely to enhance the availability of pain relief options for patients, particularly in underserved areas. Furthermore, the government is promoting research and development in the pharmaceutical sector, which may lead to the introduction of new and innovative pain relief medications. Such measures could significantly bolster the growth of the pain relief-medication market.