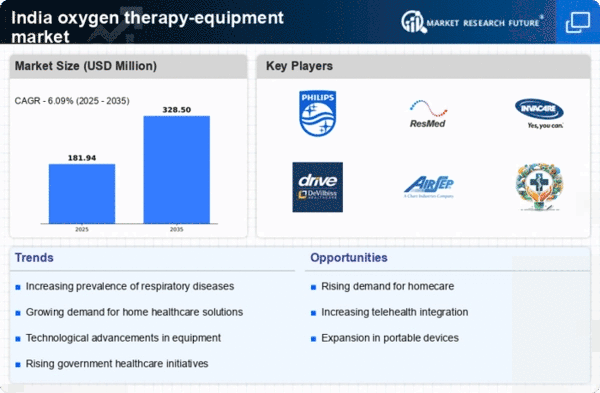

Rising Prevalence of Respiratory Disorders

The increasing incidence of respiratory disorders in India is a primary driver for the oxygen therapy-equipment market. Conditions such as chronic obstructive pulmonary disease (COPD) and asthma are becoming more prevalent, affecting millions. According to recent health statistics, approximately 10% of the Indian population suffers from some form of respiratory ailment. This growing patient base necessitates the availability of effective oxygen therapy solutions, thereby propelling market growth. The oxygen therapy-equipment market is expected to expand as healthcare providers seek to meet the rising demand for these essential devices. Furthermore, the aging population, which is more susceptible to respiratory issues, adds to the urgency for advanced oxygen therapy solutions, indicating a robust market potential in the coming years.

Growing Awareness of Home Healthcare Solutions

There is a notable shift towards home healthcare solutions in India, which is influencing the oxygen therapy-equipment market. Patients and caregivers are increasingly recognizing the benefits of receiving treatment at home, including comfort and convenience. This trend is supported by the rise in chronic diseases that require long-term oxygen therapy. Market data suggests that the home healthcare segment is projected to grow at a CAGR of 15% over the next five years. As a result, manufacturers are focusing on developing portable and user-friendly oxygen therapy devices that cater to this growing segment, thereby enhancing accessibility and affordability for patients.

Supportive Government Policies and Regulations

The Indian government is implementing supportive policies and regulations that are likely to benefit the oxygen therapy-equipment market. Initiatives aimed at improving healthcare access and affordability are being prioritized, with specific focus on respiratory health. Regulatory bodies are streamlining the approval processes for medical devices, which could facilitate quicker market entry for new products. Additionally, the government is promoting public-private partnerships to enhance the distribution of oxygen therapy equipment across various healthcare settings. This regulatory support is expected to create a conducive environment for market growth, encouraging investments and fostering innovation in the oxygen therapy-equipment market.

Increased Investment in Healthcare Infrastructure

India's government and private sector are significantly investing in healthcare infrastructure, which is likely to bolster the oxygen therapy-equipment market. Initiatives aimed at enhancing healthcare facilities, particularly in rural areas, are being prioritized. The National Health Mission has allocated substantial funds to improve healthcare access, which includes the procurement of medical equipment. As hospitals and clinics upgrade their facilities, the demand for oxygen therapy devices is expected to rise. This investment trend is anticipated to create a favorable environment for manufacturers and suppliers in the oxygen therapy-equipment market, potentially leading to innovations and improved product offerings that cater to diverse patient needs.

Technological Innovations in Oxygen Delivery Systems

Technological advancements in oxygen delivery systems are transforming the oxygen therapy-equipment market. Innovations such as portable oxygen concentrators and smart oxygen therapy devices are becoming increasingly popular. These devices not only improve patient mobility but also enhance the overall treatment experience. The integration of digital health technologies, such as remote monitoring and telemedicine, is further driving the adoption of advanced oxygen therapy solutions. As healthcare providers and patients seek more efficient and effective treatment options, the demand for these innovative products is expected to rise, indicating a dynamic shift in the market landscape.