Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and funding for respiratory care are pivotal for the oxygen therapy-equipment market. In Germany, the government has implemented various programs to support patients with chronic respiratory conditions, including subsidies for oxygen therapy equipment. These initiatives are designed to alleviate the financial burden on patients and ensure that they have access to necessary treatments. Additionally, the German healthcare system is increasingly focusing on preventive care, which includes early diagnosis and management of respiratory diseases. This proactive approach is likely to enhance the demand for oxygen therapy equipment, as more patients are identified and treated at earlier stages of their conditions. The supportive regulatory environment and funding mechanisms are expected to foster a favorable market landscape.

Technological Innovations in Equipment

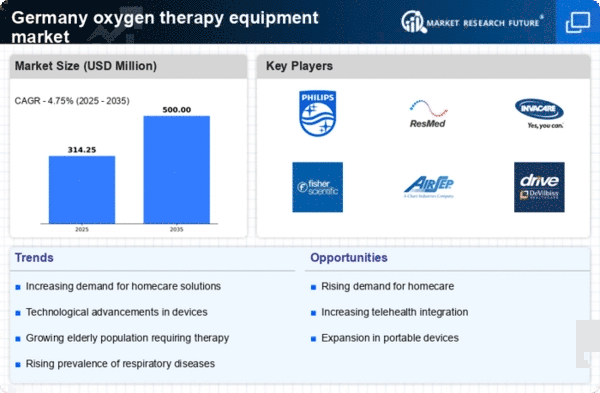

Technological advancements in oxygen therapy equipment are significantly influencing the market landscape in Germany. Innovations such as portable oxygen concentrators and advanced delivery systems are enhancing patient convenience and compliance. These devices are designed to be lightweight and user-friendly, allowing patients to maintain mobility while receiving necessary therapy. The introduction of smart technologies, including app connectivity for monitoring oxygen levels, is also gaining traction. As a result, the oxygen therapy-equipment market is likely to witness increased adoption rates, particularly among younger patients who prefer modern solutions. The integration of technology not only improves patient outcomes but also aligns with the broader trend of digital health solutions, further driving market growth.

Increasing Awareness of Home Healthcare

The growing trend towards home healthcare is reshaping the oxygen therapy-equipment market in Germany. As patients increasingly prefer receiving care in the comfort of their homes, the demand for home-based oxygen therapy solutions is on the rise. This shift is driven by several factors, including the desire for personalized care and the convenience of avoiding hospital visits. Home healthcare services are becoming more prevalent, with healthcare providers offering comprehensive support for patients requiring oxygen therapy. The oxygen therapy-equipment market is likely to benefit from this trend, as more patients seek portable and user-friendly devices that can be used at home. The emphasis on home healthcare aligns with broader healthcare trends, suggesting a sustained increase in market demand.

Rising Prevalence of Respiratory Disorders

The increasing incidence of respiratory disorders in Germany is a primary driver for the oxygen therapy-equipment market. Conditions such as chronic obstructive pulmonary disease (COPD) and asthma are becoming more prevalent, affecting a significant portion of the population. According to health statistics, approximately 6.8 million individuals in Germany are diagnosed with COPD, which necessitates the use of oxygen therapy. This growing patient base is likely to propel demand for oxygen therapy equipment, as healthcare providers seek effective solutions to manage these chronic conditions. Furthermore, the oxygen therapy-equipment market is expected to expand as awareness of respiratory health increases, leading to more patients seeking treatment options. The combination of rising disease prevalence and heightened awareness suggests a strong growth trajectory for the market in the coming years.

Aging Population and Increased Healthcare Needs

The aging population in Germany is a critical driver for the oxygen therapy equipment market. As the demographic landscape shifts, a larger segment of the population is entering older age brackets, which is often associated with a higher prevalence of chronic health conditions, including respiratory diseases. The elderly population is particularly vulnerable to conditions that require oxygen therapy, leading to an increased demand for related equipment. Current estimates indicate that by 2030, nearly 25% of the German population will be over 65 years old, further intensifying the need for effective respiratory care solutions. This demographic trend suggests that the oxygen therapy-equipment market will continue to expand, as healthcare systems adapt to meet the growing needs of an aging society.