Growing Awareness of Eye Health

There is a notable increase in public awareness regarding eye health in India, which is driving the optical coherence-tomography market. Campaigns promoting regular eye check-ups and the importance of early detection of eye diseases are becoming more prevalent. This heightened awareness is likely to encourage individuals to seek diagnostic services, thereby increasing the demand for optical coherence-tomography systems. Reports indicate that around 60% of the population is now more informed about eye health issues compared to previous years. As awareness continues to grow, the optical coherence-tomography market may experience a surge in adoption rates, as patients and healthcare providers recognize the value of advanced imaging technologies.

Increase in Geriatric Population

The increase in the geriatric population in India is a significant driver for the optical coherence-tomography market. As the population ages, the prevalence of age-related eye diseases is expected to rise, leading to a higher demand for diagnostic imaging solutions. By 2025, it is estimated that the elderly population in India will exceed 140 million, many of whom will require regular eye examinations. This demographic shift indicates a growing market for optical coherence-tomography systems, as healthcare providers aim to address the specific needs of older patients. the optical coherence-tomography market will likely expand as facilities adapt to cater to this increasing patient demographic.

Rising Prevalence of Eye Disorders

The increasing incidence of eye disorders in India is a primary driver for the optical coherence-tomography market. Conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration are becoming more prevalent, necessitating advanced diagnostic tools. According to recent health reports, approximately 30 million individuals in India are affected by diabetic retinopathy alone. This growing patient population is likely to drive demand for optical coherence-tomography systems, as they provide non-invasive imaging solutions that enhance diagnostic accuracy. This trend is expected to benefit the optical coherence-tomography market as healthcare providers seek to adopt technologies that can improve patient outcomes and streamline clinical workflows.

Technological Innovations in Imaging

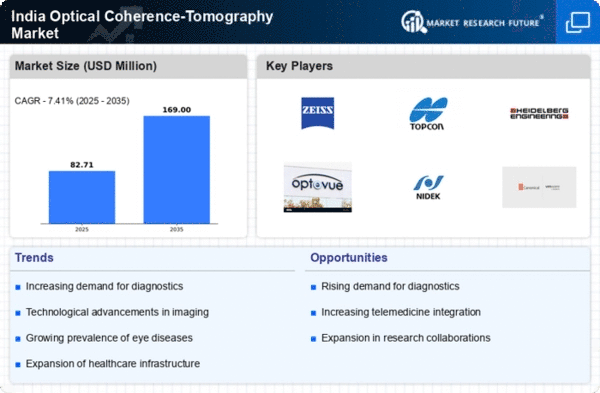

Technological innovations in imaging techniques are propelling the optical coherence-tomography market forward. The introduction of high-definition imaging and enhanced software capabilities is improving the quality of diagnostic results. Innovations such as swept-source optical coherence tomography are enabling deeper tissue imaging, which could be crucial for diagnosing complex eye conditions. As of 2025, the market is witnessing a shift towards more sophisticated systems that offer faster and more accurate results. This trend suggests that healthcare providers in India are likely to invest in cutting-edge optical coherence-tomography systems to stay competitive and provide superior patient care.

Investment in Healthcare Infrastructure

India's ongoing investment in healthcare infrastructure is significantly impacting the optical coherence-tomography market. The government has been allocating substantial funds to enhance healthcare facilities, particularly in urban and rural areas. This investment is likely to lead to the establishment of more diagnostic centers equipped with advanced imaging technologies. As of 2025, the healthcare expenditure in India is projected to reach approximately $370 billion, which may include allocations for modern diagnostic equipment. Consequently, the optical coherence-tomography market stands to gain from this infrastructural development, as hospitals and clinics upgrade their capabilities to meet the rising demand for eye care services.