Growing Emphasis on Data Analytics

The open database-connectivity market is significantly influenced by the growing emphasis on data analytics across various industries in India. Organizations are increasingly recognizing the value of data-driven insights for strategic decision-making. As a result, there is a heightened demand for tools and solutions that enable efficient data retrieval and analysis. The analytics market in India is expected to grow at a CAGR of 25% from 2023 to 2025, reflecting the urgency for businesses to harness data effectively. Open database-connectivity solutions play a crucial role in this landscape by providing the necessary infrastructure for real-time data access and integration, thereby empowering organizations to derive actionable insights and enhance their competitive edge.

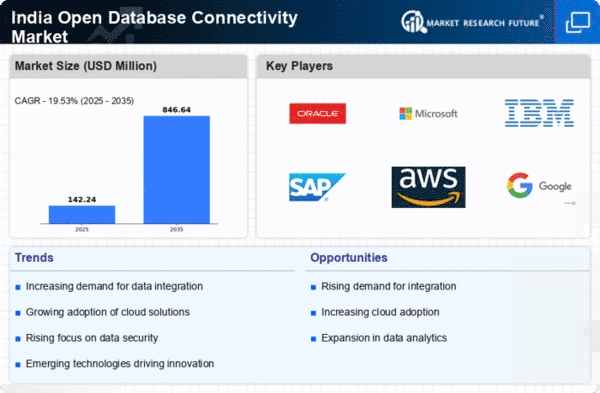

Rising Adoption of Cloud Solutions

The open database-connectivity market in India is experiencing a notable surge due to the increasing adoption of cloud-based solutions. Organizations are migrating their data to cloud platforms, which necessitates seamless database connectivity. This shift is driven by the need for scalability, flexibility, and cost-effectiveness. According to recent data, the cloud services market in India is projected to reach $10 billion by 2025, indicating a robust growth trajectory. As businesses seek to leverage cloud technologies, the demand for open database-connectivity solutions that facilitate efficient data access and management is likely to rise. This trend underscores the importance of integrating open database-connectivity solutions to enhance operational efficiency and support data-driven decision-making in various sectors.

Expansion of Internet of Things (IoT)

The expansion of the Internet of Things (IoT) in India is a pivotal driver for the open database-connectivity market. As IoT devices proliferate, the need for robust database connectivity solutions becomes increasingly apparent. These devices generate vast amounts of data that require efficient storage, retrieval, and analysis. The IoT market in India is anticipated to reach $15 billion by 2025, highlighting the potential for growth in related sectors. Open database-connectivity solutions are essential for integrating data from diverse IoT sources, enabling organizations to harness the full potential of their IoT investments. This trend indicates a growing reliance on open database-connectivity solutions to support the evolving landscape of connected devices.

Increased Focus on Business Intelligence

The open database-connectivity market is witnessing a surge in demand driven by an increased focus on business intelligence (BI) among organizations in India. Companies are investing in BI tools to enhance their decision-making processes and improve operational efficiency. The BI market is projected to grow at a CAGR of 20% over the next few years, reflecting the urgency for organizations to adopt data-driven strategies. Open database-connectivity solutions are integral to this trend, as they facilitate seamless integration of data from various sources, enabling comprehensive analysis and reporting. This growing emphasis on BI underscores the critical role of open database-connectivity solutions in empowering organizations to leverage data for strategic advantage.

Regulatory Compliance and Data Governance

In the context of the open database-connectivity market, regulatory compliance and data governance have emerged as critical drivers. With the implementation of stringent data protection regulations in India, organizations are compelled to adopt solutions that ensure compliance with legal standards. This has led to an increased focus on data governance frameworks that facilitate secure data access and management. The market for data governance solutions is projected to grow significantly, with estimates suggesting a rise of 30% by 2025. Consequently, open database-connectivity solutions that align with compliance requirements are becoming essential for organizations aiming to mitigate risks and enhance their data management practices.