Emergence of 5G Technology

The rollout of 5G technology is poised to be a transformative force for the network automation market in India. With its promise of ultra-fast connectivity and low latency, 5G is expected to drive the adoption of advanced automation solutions. As industries such as manufacturing, healthcare, and transportation embrace 5G, the demand for automated network management will likely increase. Analysts predict that the 5G market in India could reach $10 billion by 2025, creating substantial opportunities for network automation providers. This technological advancement necessitates the development of sophisticated automation tools that can support the unique requirements of 5G networks, thereby propelling the market forward.

Integration of Cloud Services

The integration of cloud services is a pivotal driver for the network automation market in India. As organizations migrate to cloud-based infrastructures, the need for automated network management becomes paramount. Cloud services facilitate scalability and flexibility, but they also introduce complexities that require sophisticated automation solutions. The market is witnessing a notable increase in investments, with projections indicating that cloud adoption could reach 70% among enterprises by 2026. This trend underscores the necessity for robust network automation tools that can seamlessly integrate with cloud environments, ensuring optimal performance and security. Consequently, the network automation market is poised for substantial growth as businesses seek to leverage cloud capabilities.

Growing Need for Real-Time Data Analytics

The demand for real-time data analytics is significantly influencing the network automation market in India. Organizations are increasingly relying on data-driven insights to make informed decisions and optimize network performance. Automation tools that provide real-time analytics enable businesses to monitor network health, identify issues proactively, and enhance overall efficiency. The market is expected to witness a growth rate of around 20% as companies invest in technologies that facilitate real-time data processing. This trend highlights the importance of integrating analytics capabilities into network automation solutions, thereby driving the market's expansion as organizations seek to harness the power of data.

Increased Focus on Operational Cost Reduction

Cost efficiency remains a critical concern for businesses in India, driving the network automation market. Organizations are increasingly seeking ways to reduce operational costs while maintaining high service quality. Automation technologies enable companies to minimize manual tasks, thereby reducing labor costs and the potential for human error. Reports suggest that companies implementing network automation can achieve cost savings of up to 30%. This financial incentive is compelling, as businesses aim to allocate resources more effectively. As a result, the network automation market is likely to expand as organizations prioritize cost-effective solutions that enhance productivity and operational efficiency.

Rising Demand for Efficient Network Management

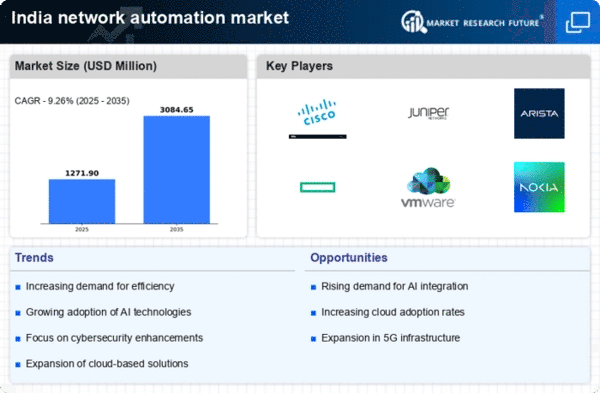

The network automation market in India is experiencing a surge in demand for efficient network management solutions. Organizations are increasingly recognizing the need to streamline operations and reduce manual intervention. This shift is driven by the growing complexity of network infrastructures, which necessitates automated solutions to enhance performance and reliability. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of the increasing reliance on automated systems to manage network resources effectively. As businesses strive for operational excellence, the adoption of network automation tools becomes essential, thereby propelling the market forward.