Enhanced Safety Awareness

There is a growing awareness regarding road safety among Indian motorcycle riders, which significantly impacts the motorcycle insurance market. Campaigns promoting safe riding practices and the importance of insurance coverage have gained traction. As a result, riders are increasingly recognizing the need for comprehensive insurance policies that offer protection against accidents and theft. This heightened awareness is reflected in the rising demand for third-party and comprehensive insurance plans. According to recent data, approximately 60% of motorcycle owners now opt for comprehensive coverage, indicating a shift in consumer preferences. The motorcycle insurance market is expected to benefit from this trend as more riders prioritize safety and financial protection.

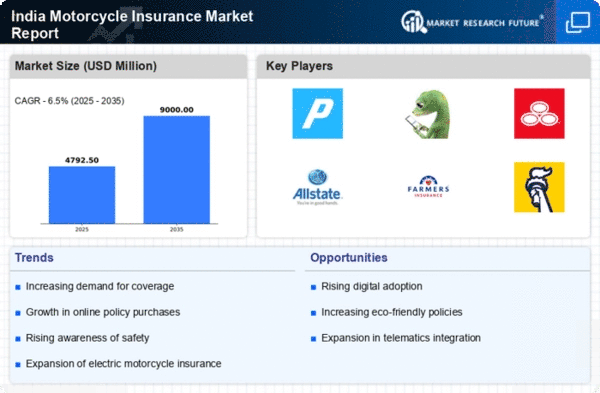

Rising Motorcycle Ownership

The increasing number of motorcycle owners in India is a primary driver for the motorcycle insurance market. As of 2025, the country has witnessed a surge in motorcycle registrations, with estimates suggesting over 20 million new motorcycles registered annually. This growth is attributed to urbanization, affordability, and the convenience of two-wheelers in congested cities. Consequently, more motorcycles on the road lead to a higher demand for insurance products. The motorcycle insurance market is likely to expand as new riders seek coverage to protect their investments and comply with legal requirements. Additionally, the rise in ownership among younger demographics indicates a shift in consumer behavior, further propelling the market forward.

Economic Growth and Disposable Income

The economic growth in India is a significant driver for the motorcycle insurance market. As the economy expands, disposable income levels are rising, allowing more individuals to invest in motorcycles. This trend is particularly evident in urban areas, where the demand for personal transportation is increasing. With more motorcycles on the road, the need for insurance coverage becomes paramount. Additionally, as consumers become more financially secure, they are more likely to opt for comprehensive insurance policies that provide extensive coverage. The motorcycle insurance market is poised for growth as economic conditions improve, leading to higher motorcycle ownership and, consequently, increased insurance demand.

Government Regulations and Initiatives

Government regulations play a crucial role in shaping the motorcycle insurance market. The implementation of mandatory insurance coverage for all two-wheelers has created a stable demand for insurance products. Recent initiatives aimed at improving road safety and reducing accidents have further emphasized the importance of insurance. The government has also introduced incentives for riders who maintain a clean driving record, which may encourage more individuals to purchase insurance. As compliance with these regulations becomes increasingly stringent, the motorcycle insurance market is likely to see a rise in policy uptake, as riders seek to adhere to legal requirements and avoid penalties.

Technological Advancements in Insurance

Technological innovations are reshaping the motorcycle insurance market in India. The integration of digital platforms for policy purchase, claim processing, and customer service has streamlined operations, making it easier for consumers to access insurance products. Insurers are leveraging data analytics and telematics to offer personalized policies based on riding behavior, which could lead to more competitive pricing. As of 2025, it is estimated that around 40% of motorcycle insurance policies are purchased online, reflecting a shift towards digital solutions. This trend not only enhances customer experience but also increases market penetration, as more riders are inclined to explore insurance options through user-friendly digital interfaces.