Rising Motorcycle Ownership

The increasing number of motorcycle owners in Japan is a pivotal driver for the motorcycle insurance market. As of recent data, motorcycle registrations have shown a steady growth of approximately 5% annually, reflecting a cultural shift towards two-wheeled transportation. This trend is particularly pronounced in urban areas where traffic congestion encourages the use of motorcycles. Consequently, more motorcycles on the road lead to a higher demand for insurance products tailored to this demographic. Insurers are responding by developing specialized policies that cater to the unique needs of motorcycle owners, thus expanding the market. The rising ownership not only boosts the number of potential policyholders but also enhances competition among insurers, which may lead to more innovative offerings in the motorcycle insurance market.

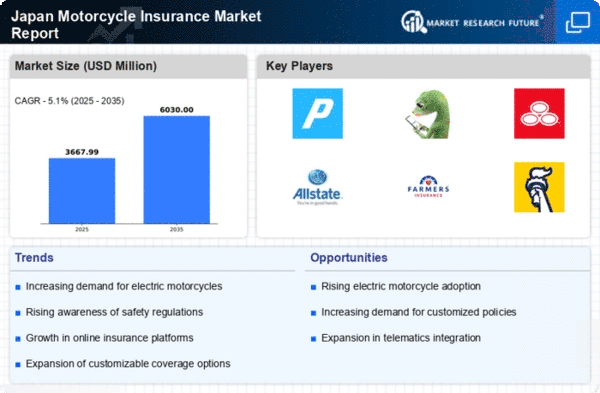

Regulatory Changes and Compliance

Regulatory frameworks governing the motorcycle insurance market in Japan are evolving, which significantly impacts the industry. Recent legislative changes have mandated stricter insurance requirements for motorcycle riders, including compulsory liability coverage. This shift aims to enhance road safety and protect both riders and other road users. As a result, insurance providers are compelled to adapt their offerings to comply with these regulations, potentially increasing the overall market size. The compliance costs associated with these changes may also influence premium pricing strategies. Insurers that proactively align their products with regulatory expectations are likely to gain a competitive edge in the motorcycle insurance market, thereby attracting more customers seeking compliant coverage.

Growing Awareness of Safety Measures

There is a notable increase in awareness regarding safety measures among motorcycle riders in Japan, which is positively influencing the motorcycle insurance market. Educational campaigns and community initiatives have emphasized the importance of wearing helmets and protective gear, as well as adhering to traffic regulations. This heightened awareness is likely to result in fewer accidents, thereby reducing claims and potentially lowering premiums over time. Insurers may respond by offering discounts for riders who demonstrate safe riding habits, further incentivizing responsible behavior. As safety becomes a priority for riders, the motorcycle insurance market may see a shift towards policies that reward safety-conscious individuals, fostering a culture of responsible riding.

Economic Factors Influencing Insurance Demand

Economic conditions in Japan play a significant role in shaping the motorcycle insurance market. Fluctuations in disposable income and consumer spending can directly impact the demand for motorcycle insurance. In periods of economic growth, individuals are more inclined to invest in motorcycles, subsequently increasing the need for insurance coverage. Conversely, during economic downturns, potential buyers may delay motorcycle purchases, affecting the market negatively. Additionally, the overall economic climate influences premium pricing, as insurers must balance affordability with risk management. As the economy continues to evolve, its effects on consumer behavior and insurance demand will remain a critical driver for the motorcycle insurance market.

Technological Advancements in Insurance Solutions

Technological innovations are reshaping the motorcycle insurance market in Japan, offering new opportunities for both insurers and consumers. The integration of telematics and mobile applications allows for real-time monitoring of riding behavior, which can lead to personalized insurance premiums based on individual risk profiles. This data-driven approach not only enhances customer engagement but also promotes safer riding practices. Furthermore, the use of artificial intelligence in claims processing is streamlining operations, reducing turnaround times for policyholders. As technology continues to advance, it is likely to play a crucial role in shaping the future landscape of the motorcycle insurance market, making it more efficient and customer-centric.