Rising Smartphone Penetration

The mobile augmented-reality market in India is experiencing a surge due to the increasing penetration of smartphones. As of 2025, smartphone users in India are projected to reach approximately 1.2 billion, representing a significant growth trajectory. This widespread adoption of smartphones facilitates access to augmented-reality applications, thereby enhancing user engagement and interaction. The mobile augmented-reality market is likely to benefit from this trend. More consumers are becoming familiar with AR technologies through their devices. Furthermore, the affordability of smartphones has made them accessible to a broader demographic, which could potentially expand the user base for mobile augmented-reality applications. This growing market segment may lead to innovative AR solutions tailored to various industries, including gaming, education, and retail, thereby driving further growth in the mobile augmented-reality market.

Expansion of 5G Infrastructure

The rollout of 5G technology in India is poised to revolutionize the mobile augmented-reality market. With significantly higher data speeds and lower latency, 5G networks enable seamless AR experiences that were previously unattainable. As of November 2025, major cities in India are witnessing the deployment of 5G infrastructure, which is expected to enhance the performance of mobile augmented-reality applications. This technological advancement may lead to more sophisticated AR experiences, such as real-time interactions and high-quality graphics. As users increasingly adopt 5G-enabled devices, the mobile augmented-reality market is likely to see a surge in demand for applications that leverage these capabilities, ultimately transforming how consumers engage with augmented-reality content.

Government Initiatives and Support

The Indian government is actively promoting digital transformation, which significantly impacts the mobile augmented-reality market. Initiatives such as Digital India aim to enhance technology adoption across various sectors, including education and healthcare. By providing funding and support for technology startups, the government encourages innovation in mobile augmented-reality applications. As a result, the the mobile augmented-reality market is likely to experience an influx of new solutions catering to local needs. Additionally, government-backed programs may facilitate partnerships between educational institutions and AR developers, fostering a collaborative environment for research and development. This supportive ecosystem could lead to the emergence of cutting-edge AR technologies, further propelling the mobile augmented-reality market in India.

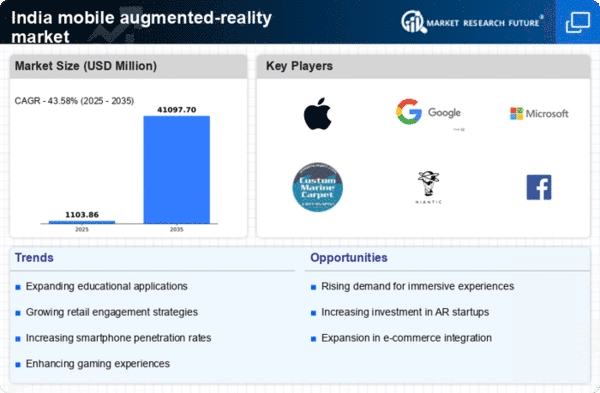

Increased Investment in AR Startups

Investment in augmented-reality startups in India is on the rise, which is a crucial driver for the mobile augmented-reality market. Venture capitalists and angel investors are increasingly recognizing the potential of AR technologies, leading to a surge in funding for innovative startups. In 2025, investments in AR-related ventures are expected to exceed $500 million, indicating a robust interest in this sector. This influx of capital allows startups to develop and refine their mobile augmented-reality applications, enhancing user experiences and expanding market reach. As these startups introduce novel solutions, the mobile augmented-reality market is likely to witness accelerated growth, driven by fresh ideas and competitive offerings that cater to diverse consumer needs.

Growing Demand for Interactive Marketing

The mobile augmented-reality market is benefiting from the growing demand for interactive marketing strategies among businesses in India. Companies are increasingly leveraging AR technologies to create immersive advertising experiences that engage consumers more effectively. As of 2025, it is estimated that around 30% of Indian brands are expected to incorporate augmented-reality elements into their marketing campaigns. This trend not only enhances brand visibility but also fosters deeper connections with consumers. By utilizing AR, businesses can provide unique experiences that differentiate them from competitors, thereby driving sales and customer loyalty. Consequently, the mobile augmented-reality market is likely to expand as more companies recognize the value of interactive marketing solutions.