Enhanced User Engagement

The Mobile Augmented Reality Market is witnessing a surge in user engagement due to the immersive experiences it offers. Companies are increasingly leveraging AR technology to create interactive content that captivates users. For instance, brands are utilizing AR applications to allow customers to visualize products in their own environment before making a purchase. This not only enhances the shopping experience but also increases conversion rates. According to recent data, businesses that have integrated AR into their marketing strategies report a 70% increase in customer engagement. As a result, the demand for AR solutions is expected to grow, driving the Mobile Augmented Reality Market further.

Advancements in AR Technology

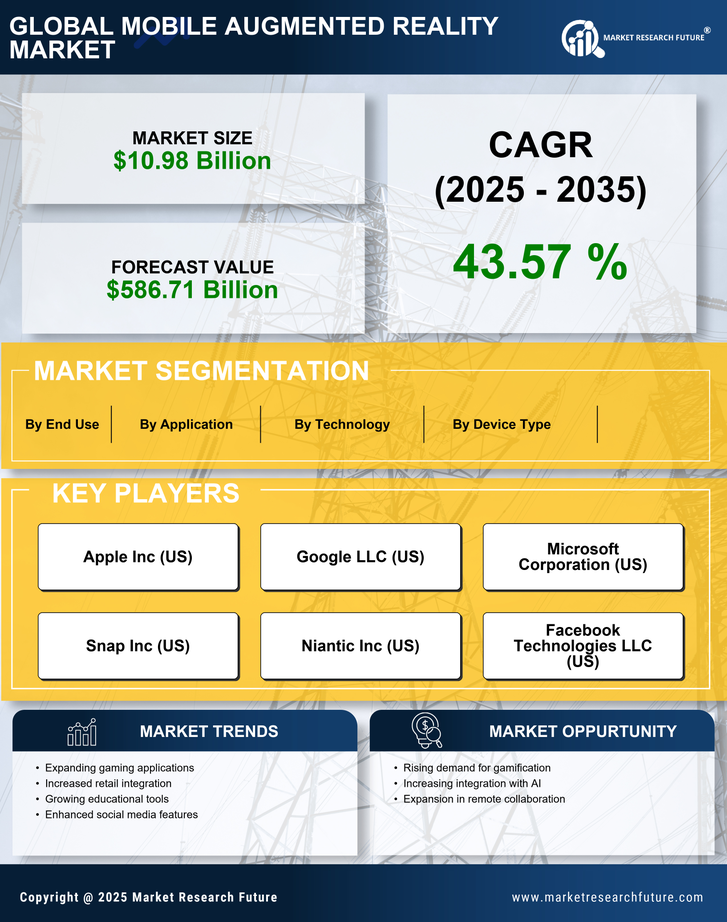

The Mobile Augmented Reality Market is benefiting from continuous advancements in AR technology. Innovations in hardware, such as improved smartphones and wearable devices, are enhancing the capabilities of AR applications. Additionally, software developments are enabling more sophisticated AR experiences, making them more accessible to consumers. As technology evolves, the Mobile Augmented Reality Market is expected to expand, with projections indicating a compound annual growth rate of over 30% in the coming years. These advancements not only improve user experiences but also attract new industries to adopt AR solutions, further driving market growth.

Growth in Gaming Applications

The Mobile Augmented Reality Market is significantly influenced by the expansion of gaming applications. The popularity of AR games, such as those that blend real-world environments with digital elements, has attracted a vast audience. This trend is evidenced by the success of titles that have generated billions in revenue, indicating a robust market potential. The gaming sector is projected to account for a substantial share of the Mobile Augmented Reality Market, with estimates suggesting it could reach over 50% of the total market by 2026. This growth is likely to encourage further investment in AR technologies, enhancing the overall market landscape.

Increased Investment in AR Startups

The Mobile Augmented Reality Market is experiencing a notable increase in investment directed towards AR startups. Venture capitalists and tech giants are recognizing the potential of AR technologies, leading to a surge in funding. In recent years, investments in AR-related startups have exceeded billions, indicating a strong belief in the future of this technology. This influx of capital is likely to accelerate innovation and development within the Mobile Augmented Reality Market, resulting in new applications and improved user experiences. As more startups emerge, the competitive landscape will evolve, further propelling market growth.

Integration with E-commerce Platforms

The Mobile Augmented Reality Market is increasingly integrating with e-commerce platforms, enhancing the online shopping experience. Retailers are adopting AR solutions to provide virtual try-ons and product visualizations, allowing consumers to interact with products before purchasing. This integration is expected to drive sales and reduce return rates, as customers can make more informed decisions. Recent studies indicate that AR-enhanced shopping experiences can lead to a 30% increase in sales conversions. As e-commerce continues to expand, the role of AR in the Mobile Augmented Reality Market will likely become more pronounced, shaping the future of online retail.