Increasing Geriatric Population

The rising geriatric population in India is a significant driver for the medical imaging-workstations market. As the elderly population grows, the prevalence of age-related health issues, such as cardiovascular diseases and cancers, is also increasing. This demographic shift necessitates enhanced diagnostic capabilities, leading to a higher demand for advanced imaging workstations. According to projections, the geriatric population is expected to reach 300 million by 2030, which will likely result in a corresponding increase in the medical imaging-workstations market. Healthcare providers are thus compelled to invest in sophisticated imaging technologies to cater to the needs of this expanding demographic.

Government Initiatives and Support

Government initiatives aimed at improving healthcare infrastructure are significantly impacting the medical imaging-workstations market in India. Various schemes and policies have been introduced to enhance healthcare accessibility and affordability. For instance, the National Health Mission has allocated substantial funds for upgrading medical facilities, which includes the procurement of advanced imaging workstations. This support is likely to stimulate market growth, as healthcare institutions are encouraged to invest in modern imaging technologies. The government's focus on enhancing healthcare services is expected to contribute to a projected increase in the medical imaging-workstations market by approximately 15% in the coming years.

Rising Demand for Diagnostic Imaging

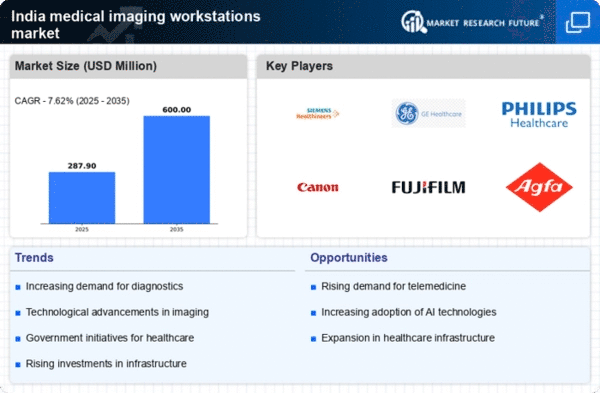

The medical imaging-workstations market in India is experiencing a notable surge in demand for diagnostic imaging solutions. This increase is primarily driven by the growing awareness of early disease detection and the need for accurate diagnostics. As healthcare providers strive to enhance patient outcomes, the adoption of advanced imaging technologies is becoming essential. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years. This trend indicates a robust expansion in the medical imaging-workstations market, as hospitals and diagnostic centers invest in state-of-the-art imaging systems to meet the rising demand for precise diagnostic capabilities.

Shift Towards Value-Based Healthcare

The transition towards value-based healthcare is influencing the medical imaging-workstations market in India. This approach emphasizes patient outcomes and cost-effectiveness, prompting healthcare providers to adopt advanced imaging technologies that enhance diagnostic accuracy and treatment efficacy. As hospitals and clinics focus on delivering high-quality care while managing costs, the demand for efficient imaging workstations is expected to rise. This shift is likely to drive market growth, with estimates indicating that value-based care initiatives could lead to a 20% increase in the medical imaging-workstations market over the next five years. The emphasis on quality and efficiency is reshaping the landscape of healthcare delivery.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning technologies into medical imaging is transforming the landscape of the medical imaging-workstations market in India. These technologies enhance image analysis, improve diagnostic accuracy, and streamline workflows. As healthcare providers seek to optimize their operations, the adoption of AI-driven imaging solutions is becoming increasingly prevalent. This trend is expected to drive market growth, with estimates suggesting that AI-enabled imaging systems could account for over 30% of the market share by 2030. The potential for improved patient outcomes and operational efficiency positions AI as a key driver in the evolution of the medical imaging-workstations market.