Focus on Patient-Centric Care

The shift towards patient-centric care in the UK healthcare system is influencing the medical imaging-workstations market. Healthcare providers are increasingly prioritising patient experience and outcomes, which necessitates the use of advanced imaging technologies. Medical imaging workstations that offer user-friendly interfaces and rapid image processing capabilities are becoming essential tools for radiologists and clinicians. This focus on patient care is likely to drive investments in imaging workstations, as facilities seek to improve diagnostic workflows and reduce patient wait times. As a result, the medical imaging-workstations market is expected to expand in response to these evolving healthcare priorities.

Government Initiatives and Funding

Government initiatives aimed at enhancing healthcare infrastructure in the UK are positively affecting the medical imaging-workstations market. Increased funding for healthcare facilities, particularly in underserved areas, is leading to the acquisition of advanced imaging technologies. The UK government has allocated substantial budgets to improve diagnostic services, which includes the procurement of medical imaging workstations. This financial support is likely to stimulate market growth, as healthcare providers are encouraged to upgrade their imaging capabilities to meet rising patient demands and regulatory standards.

Rising Demand for Diagnostic Imaging

The increasing prevalence of chronic diseases in the UK is significantly impacting the medical imaging-workstations market. As conditions such as cardiovascular diseases and cancer become more common, the demand for diagnostic imaging services rises correspondingly. According to recent statistics, the number of imaging procedures performed annually in the UK has increased by over 10% in the last three years. This trend necessitates the deployment of advanced medical imaging workstations to handle the growing volume of data and improve patient outcomes. Consequently, healthcare providers are investing in state-of-the-art imaging workstations to enhance their diagnostic capabilities.

Growing Importance of Data Management Solutions

The medical imaging-workstations market is also being driven by the growing importance of data management solutions. As imaging technologies evolve, the volume of data generated increases, necessitating robust data management systems. These systems enable healthcare providers to store, retrieve, and analyse imaging data efficiently. In the UK, the integration of cloud-based solutions and advanced data analytics is becoming more prevalent, allowing for better collaboration among healthcare professionals. This trend is likely to enhance the functionality of medical imaging workstations, making them indispensable in modern healthcare settings.

Technological Advancements in Imaging Equipment

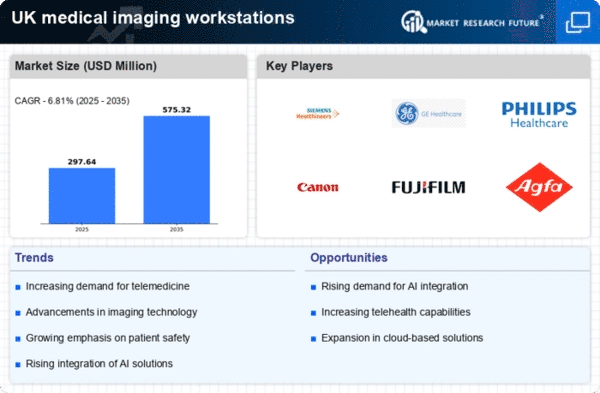

The medical imaging-workstations market is experiencing a surge due to rapid technological advancements in imaging equipment. Innovations such as high-resolution displays, advanced image processing software, and enhanced connectivity features are driving demand. The integration of these technologies allows for improved diagnostic accuracy and efficiency, which is crucial in clinical settings. In the UK, the market for imaging equipment is projected to grow at a CAGR of approximately 5.5% over the next five years. This growth is largely attributed to the increasing need for precise imaging solutions in hospitals and diagnostic centres, thereby propelling the medical imaging-workstations market forward.