Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies is a key driver for the location analytics market in India. The proliferation of IoT devices across various industries is generating vast amounts of location-based data, which can be harnessed for analytics. Industries such as transportation, agriculture, and healthcare are increasingly adopting IoT solutions to monitor assets and optimize operations. The Indian IoT market is projected to reach $15 billion by 2025, indicating a robust growth trajectory. As organizations seek to leverage IoT-generated data for actionable insights, the demand for location analytics solutions is likely to increase. This integration allows businesses to enhance operational efficiency, improve resource allocation, and make informed decisions based on real-time data. Consequently, the location analytics market is expected to benefit from the growing adoption of IoT technologies, as organizations recognize the value of combining location data with IoT insights.

Advancements in Mobile Technology

The rapid advancements in mobile technology are significantly influencing the location analytics market in India. With the proliferation of smartphones and mobile applications, businesses are increasingly utilizing location-based services to engage customers effectively. The mobile penetration rate in India has surpassed 80%, providing a vast user base for location-driven applications. This trend is likely to enhance the demand for location analytics solutions, as companies seek to harness mobile data for targeted marketing and personalized services. Moreover, the integration of GPS and location tracking features in mobile devices enables real-time data collection, which is crucial for businesses aiming to optimize their operations. Consequently, the location analytics market is expected to benefit from the growing reliance on mobile technology, as organizations strive to leverage mobile insights for strategic decision-making.

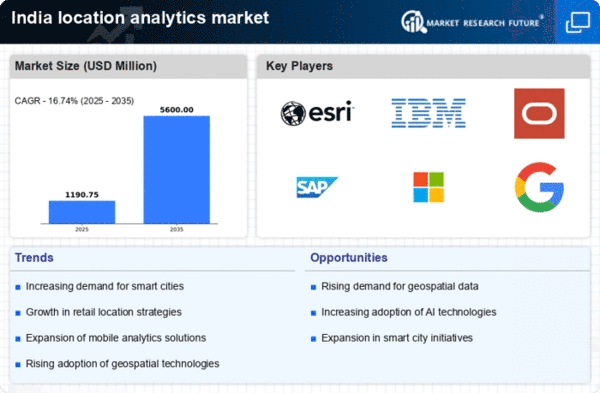

Growing Demand for Geospatial Data

The increasing reliance on geospatial data is a pivotal driver for the location analytics market in India. Businesses across various sectors, including retail, logistics, and urban planning, are leveraging geospatial insights to enhance decision-making processes. The market for geospatial data is projected to grow at a CAGR of approximately 20% over the next five years. This growth is fueled by the need for precise location-based information to optimize operations and improve customer experiences. As organizations recognize the value of integrating geospatial data into their strategies, the location analytics market is likely to witness substantial expansion. Furthermore, government initiatives promoting smart cities and digital infrastructure are expected to further stimulate demand for geospatial solutions, thereby reinforcing the importance of geospatial data in the location analytics market.

Government Initiatives and Policies

Government initiatives aimed at enhancing digital infrastructure and promoting data-driven decision-making are crucial drivers for the location analytics market in India. Programs such as Digital India and Smart Cities Mission are fostering an environment conducive to the adoption of location analytics solutions. These initiatives encourage the use of data analytics for urban planning, resource management, and public service delivery. The Indian government has allocated substantial funding for infrastructure development, which is likely to create opportunities for location analytics providers. As public sector organizations increasingly adopt location-based technologies to improve efficiency and transparency, the location analytics market is poised for growth. Furthermore, regulatory frameworks supporting data privacy and security will play a vital role in shaping the market landscape, ensuring that organizations can leverage location analytics while adhering to compliance standards.

Rising Importance of Customer Experience

The emphasis on enhancing customer experience is a significant driver for the location analytics market in India. Businesses are increasingly recognizing that understanding customer behavior and preferences is essential for maintaining a competitive edge. By utilizing location analytics, companies can gain insights into customer journeys, preferences, and purchasing patterns. This information enables businesses to tailor their offerings and marketing strategies effectively. The retail sector, in particular, is leveraging location analytics to optimize store placements and improve inventory management. As organizations strive to create personalized experiences for their customers, the demand for location analytics solutions is expected to rise. This trend indicates a shift towards data-driven decision-making, where businesses prioritize customer-centric strategies, thereby propelling the growth of the location analytics market.