Rising E-Waste Generation

The increasing reliance on electronic devices in India has led to a substantial rise in e-waste generation, which includes lithium-ion batteries. As per recent estimates, India generates approximately 2 million tonnes of e-waste annually, with a significant portion attributed to discarded batteries. This surge in e-waste necessitates effective recycling solutions, thereby driving the li ion-battery-recycling market. The government has recognized this challenge and is likely to implement stricter regulations to manage e-waste, which could further bolster the recycling industry. The need for sustainable disposal methods is becoming increasingly urgent, as improper disposal poses environmental hazards. Consequently, the li ion-battery-recycling market is positioned to grow as stakeholders seek to address these pressing issues.

Increasing Electric Vehicle Adoption

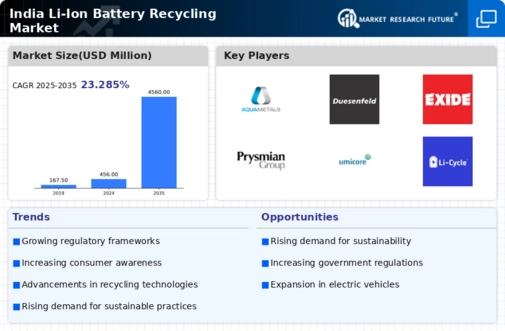

The rapid adoption of electric vehicles (EVs) in India is a pivotal driver for the li ion-battery-recycling market. With the government's push for electric mobility, the number of EVs on Indian roads is projected to reach 30 million by 2030. This surge in EV usage will inevitably lead to a corresponding increase in battery disposal and recycling needs. The lifecycle of lithium-ion batteries necessitates efficient recycling processes to recover valuable materials such as lithium, cobalt, and nickel. As the demand for EVs grows, so does the urgency for effective recycling solutions, which could potentially create a market worth over $1 billion by 2025. This trend indicates a promising future for the li ion-battery-recycling market, as stakeholders seek to capitalize on the opportunities presented by the burgeoning EV sector.

Technological Innovations in Recycling

Technological advancements in recycling processes are transforming the li ion-battery-recycling market in India. Innovations such as hydrometallurgical and pyrometallurgical methods are enhancing the efficiency of material recovery from spent batteries. These technologies not only improve recovery rates but also reduce environmental impact, aligning with global sustainability goals. As the industry evolves, companies are likely to invest in research and development to optimize these processes further. The potential for recovering up to 95% of battery materials through advanced recycling techniques could significantly lower the costs associated with raw material procurement. This technological shift is expected to attract investments and drive growth in the li ion-battery-recycling market, as stakeholders recognize the economic and environmental benefits of adopting cutting-edge recycling solutions.

Government Initiatives for Sustainability

The Indian government is actively promoting sustainability through various initiatives aimed at enhancing recycling practices. Programs such as the National Policy on Electronics emphasize the importance of recycling and resource recovery from electronic waste, including lithium-ion batteries. The government has set ambitious targets to increase recycling rates, which could reach up to 30% by 2030. This regulatory framework is expected to create a conducive environment for the li ion-battery-recycling market, encouraging investments in recycling infrastructure and technology. Furthermore, public-private partnerships are likely to emerge, facilitating knowledge transfer and innovation in recycling processes. As these initiatives gain traction, the market is anticipated to witness significant growth, driven by both regulatory support and the need for sustainable practices.

Rising Consumer Demand for Sustainable Products

There is a noticeable shift in consumer preferences towards sustainable products in India, which is influencing the li ion-battery-recycling market. As awareness of environmental issues grows, consumers are increasingly seeking products that are eco-friendly and responsibly sourced. This trend is particularly evident in the electronics and automotive sectors, where consumers are more inclined to choose brands that prioritize sustainability. Companies are responding by implementing recycling programs and promoting the use of recycled materials in their products. This consumer-driven demand is likely to propel the li ion-battery-recycling market, as manufacturers strive to meet the expectations of environmentally conscious consumers. The market could see a significant uptick as businesses align their strategies with this growing consumer sentiment, potentially leading to a more sustainable future.