Rising Electric Vehicle Adoption

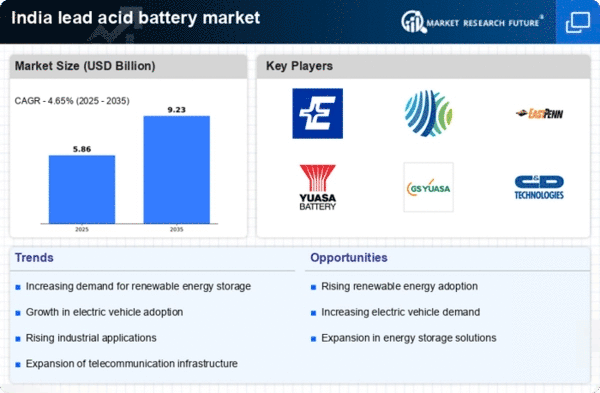

The lead acid-battery market in India is experiencing a notable boost due to the increasing adoption of electric vehicles (EVs). As the Indian government promotes EVs through various incentives and subsidies, the demand for reliable energy storage solutions rises. Lead acid batteries, known for their cost-effectiveness and robustness, are often utilized in entry-level EVs. In 2025, the EV segment is projected to account for approximately 15% of the total automotive market, thereby driving the lead acid-battery market. This trend indicates a shift towards sustainable transportation, which may further enhance the market's growth as manufacturers seek to meet the evolving energy storage needs of the automotive sector.

Telecommunications Sector Growth

The telecommunications sector in India is expanding rapidly, which is likely to bolster the lead acid-battery market. As mobile network operators invest in enhancing connectivity, the demand for backup power solutions becomes critical. Lead acid batteries are commonly employed in telecom towers to ensure uninterrupted service during power outages. With the number of mobile subscribers projected to reach 1.2 billion by 2025, the telecommunications industry is expected to grow significantly. This growth may lead to an increased requirement for lead acid batteries, as they provide a reliable and cost-effective energy storage solution for the sector.

Agricultural Mechanization Trends

The lead acid-battery market in India is also influenced by the trends in agricultural mechanization. As farmers increasingly adopt modern machinery for farming operations, the demand for reliable power sources rises. Lead acid batteries are often used in agricultural equipment such as tractors and irrigation systems. With the Indian government promoting initiatives to enhance agricultural productivity, the mechanization rate is expected to increase, potentially reaching 50% by 2025. This trend suggests a growing market for lead acid batteries, as they provide the necessary power for efficient agricultural practices, thereby supporting the overall growth of the lead acid-battery market.

Energy Storage for Renewable Sources

The The market is likely to benefit from the increasing integration of renewable energy sources in India.. As the country aims to achieve 175 GW of renewable energy capacity by 2025, the need for effective energy storage solutions becomes paramount. Lead acid batteries are often utilized for storing energy generated from solar and wind sources, providing a reliable backup during periods of low generation. This trend indicates a potential growth area for the lead acid-battery market, as it aligns with the government's commitment to sustainable energy solutions and the transition towards a greener economy.

Infrastructure Development Initiatives

India's ongoing infrastructure development initiatives significantly impact the lead acid-battery market. The government's focus on enhancing transportation networks, including roads and railways, necessitates reliable power sources for various applications. Lead acid batteries are widely used in backup power systems for signaling and communication in these projects. With an estimated investment of over $1 trillion in infrastructure by 2025, the demand for lead acid batteries is likely to surge. This growth is further supported by the need for uninterrupted power supply in construction sites and transportation systems, indicating a robust market potential for lead acid batteries in the infrastructure sector.