Rising Healthcare Expenditure

The increase in healthcare expenditure in India is a significant driver for This market.. With the government and private sectors investing more in healthcare infrastructure, access to advanced medical treatments is improving. In recent years, healthcare spending has risen to approximately 3.5% of GDP, reflecting a growing commitment to enhancing health services. This increase in expenditure facilitates the availability of cutting-edge medical technologies and surgical procedures, making knee replacements more accessible to a larger segment of the population. Additionally, the expansion of health insurance coverage is likely to further support this trend, as more individuals can afford knee replacement surgeries. As healthcare expenditure continues to rise, the knee replacement market is expected to experience robust growth, driven by increased access to necessary medical interventions.

Growing Awareness of Joint Health

There is a notable increase in awareness regarding joint health among the Indian population, which is positively influencing This market.. Educational campaigns and health initiatives are emphasizing the importance of maintaining joint health and the available treatment options for joint-related ailments. This heightened awareness is leading to earlier diagnosis and treatment of conditions that may require knee replacement. Furthermore, the proliferation of information through digital platforms and social media is empowering patients to seek medical advice sooner. As individuals become more informed about the benefits of knee replacement surgeries, the demand for these procedures is likely to rise. This trend suggests that the knee replacement market will continue to expand as more patients recognize the potential for improved mobility and quality of life through surgical intervention.

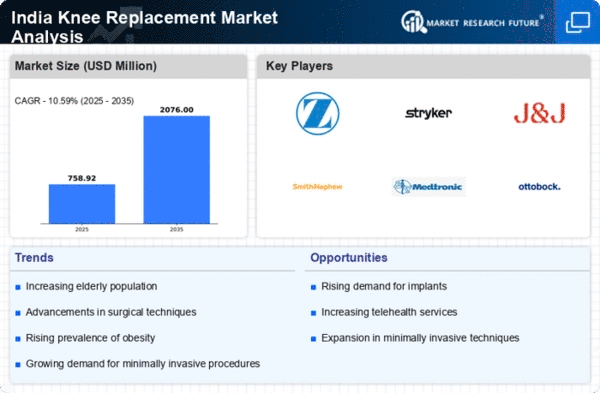

Advancements in Surgical Techniques

Innovations in surgical techniques are transforming This market. in India. Minimally invasive procedures, such as arthroscopy and robotic-assisted surgeries, are gaining traction due to their potential to reduce recovery times and improve patient outcomes. These advancements not only enhance the precision of the surgeries but also minimize complications, which is particularly appealing to both patients and healthcare providers. The adoption of these modern techniques is expected to increase the number of knee replacement surgeries performed annually. According to recent data, hospitals that implement advanced surgical methods report a 30% increase in patient satisfaction and a 25% reduction in hospital stay duration. As more healthcare facilities in India adopt these innovative approaches, the knee replacement market is poised for significant growth, driven by improved surgical outcomes and patient experiences.

Increased Incidence of Sports Injuries

The rising incidence of sports injuries in India is emerging as a significant driver for This market.. With a growing interest in sports and fitness activities, particularly among the youth, the number of knee injuries is on the rise. Injuries such as ligament tears and cartilage damage often lead to chronic pain and may necessitate surgical intervention. Data indicates that sports-related knee injuries have increased by approximately 20% over the past decade, prompting a greater need for knee replacement surgeries. As awareness of sports injuries and their long-term implications grows, individuals are more likely to seek surgical solutions to restore their knee function. Consequently, the knee replacement market is expected to benefit from this trend, as more athletes and active individuals turn to surgical options to address their knee-related issues.

Increasing Prevalence of Osteoarthritis

The rising incidence of osteoarthritis in India is a crucial driver for This market.. As the population ages, the prevalence of this degenerative joint disease increases, leading to a higher demand for knee replacement surgeries. Studies indicate that approximately 15-20% of the Indian population over 60 years suffers from osteoarthritis, which significantly impacts mobility and quality of life. This growing health concern necessitates effective treatment options, thereby propelling This market. forward. Furthermore, the economic burden associated with osteoarthritis management is substantial, with costs related to treatment and lost productivity estimated to reach billions of rupees annually. Consequently, the increasing prevalence of osteoarthritis is likely to stimulate growth in This market., as patients seek surgical interventions to alleviate pain and restore function.