Emergence of Industry 4.0

The transition towards Industry 4.0 in India is driving the demand for IoT solutions across manufacturing sectors. This paradigm shift emphasizes automation, data exchange, and smart manufacturing processes, which are heavily reliant on IoT technologies. As industries adopt IoT-enabled devices for real-time monitoring and predictive maintenance, the iot telecom-services market is expected to witness substantial growth. The manufacturing sector is projected to invest over $5 billion in IoT technologies by 2026, indicating a strong commitment to digital transformation. This trend not only enhances operational efficiency but also fosters innovation, positioning India as a competitive player in the global manufacturing landscape.

Expansion of 5G Infrastructure

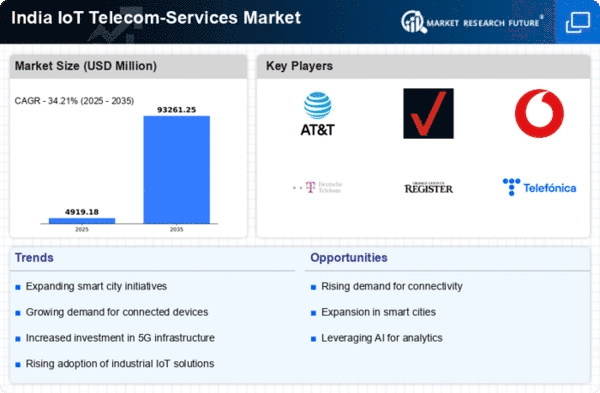

The rollout of 5G technology in India is poised to be a pivotal driver for the iot telecom-services market. With its high-speed connectivity and low latency, 5G enables a plethora of IoT applications, ranging from smart cities to industrial automation. The Indian government has allocated substantial resources to enhance telecommunications infrastructure, with investments projected to reach $10 billion by 2025. This expansion is expected to facilitate seamless communication between devices, thereby fostering innovation in various sectors. As a result, the iot telecom-services market is likely to experience accelerated growth, with an anticipated CAGR of 25% over the next five years. The enhanced capabilities of 5G are expected to attract both domestic and international players, further stimulating competition and investment in the market.

Growing Focus on Healthcare Innovations

The healthcare sector in India is increasingly leveraging IoT technologies to improve patient care and operational efficiency. The rise of telemedicine, remote patient monitoring, and smart medical devices is driving the demand for IoT telecom-services. With the Indian healthcare market projected to reach $372 billion by 2022, the integration of IoT solutions is expected to play a crucial role in this growth. Hospitals and healthcare providers are investing in IoT technologies to enhance patient outcomes and streamline operations. This trend indicates a significant opportunity for the iot telecom-services market, as healthcare providers seek to adopt innovative solutions that can improve service delivery and reduce costs.

Increased Adoption of Smart Agriculture

The agricultural sector in India is increasingly embracing IoT solutions to enhance productivity and sustainability. The adoption of smart agriculture technologies, such as precision farming and remote monitoring, is driving demand for IoT telecom-services. Farmers are utilizing IoT devices to monitor soil conditions, weather patterns, and crop health, leading to improved yields and resource management. The market for smart agriculture is projected to grow at a CAGR of 20% from 2025 to 2030, indicating a robust opportunity for the iot telecom-services market. This trend is further supported by government initiatives aimed at digitizing agriculture, which could potentially lead to a more efficient supply chain and reduced wastage, thereby benefiting both farmers and consumers.

Rising Urbanization and Smart City Projects

India's rapid urbanization is a significant driver for the iot telecom-services market. As urban populations grow, the demand for smart city solutions, including intelligent transportation systems, waste management, and energy efficiency, is on the rise. The Indian government has launched several smart city initiatives, with an investment of approximately $1.5 billion aimed at developing 100 smart cities across the country. This initiative is expected to create a substantial demand for IoT services, as cities seek to integrate technology into their infrastructure. The iot telecom-services market is likely to benefit from this trend, as urban planners and local governments increasingly rely on IoT solutions to enhance the quality of life for residents and improve operational efficiency.