Evolving Regulatory Landscape

The regulatory environment surrounding the iot telecom-services market in Japan is evolving, which presents both challenges and opportunities for telecom providers. Recent government policies aimed at promoting IoT adoption and ensuring data security are reshaping the market dynamics. For instance, regulations mandating the protection of personal data are compelling companies to enhance their security measures, which may incur additional costs. However, these regulations also create a framework that fosters consumer trust and encourages investment in IoT technologies. As businesses navigate this evolving landscape, they are likely to seek innovative solutions that comply with regulatory requirements while maximizing operational efficiency. Thus, the changing regulatory landscape is expected to play a pivotal role in shaping the future of the iot telecom-services market.

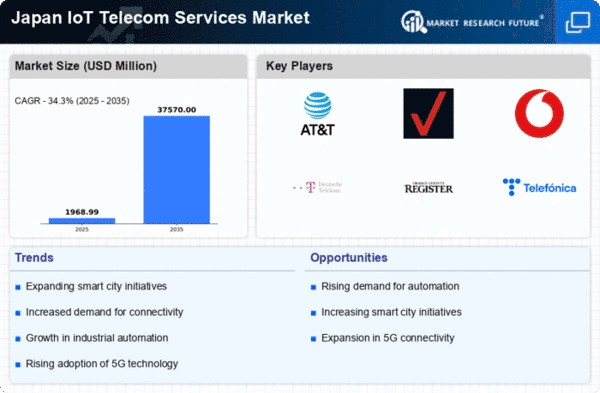

Expansion of Smart City Initiatives

The development of smart city initiatives in Japan is significantly influencing the iot telecom-services market. As urban areas increasingly adopt IoT technologies to enhance infrastructure and public services, telecom providers are presented with new opportunities for growth. These initiatives encompass a wide range of applications, including smart transportation systems, energy management, and public safety solutions. The Japanese government has allocated substantial funding for smart city projects, which is expected to exceed ¥1 trillion by 2025. This investment not only fosters innovation but also encourages collaboration between telecom companies and local governments. As a result, the expansion of smart city initiatives is likely to drive demand for advanced telecom services, thereby propelling the growth of the iot telecom-services market.

Advancements in Data Analytics and AI

The integration of advanced data analytics and artificial intelligence (AI) into the iot telecom-services market is transforming how data is processed and utilized. Telecom companies in Japan are increasingly leveraging AI to optimize network performance and enhance customer experiences. By analyzing vast amounts of data generated by IoT devices, companies can identify patterns and trends, leading to more informed decision-making. This trend is expected to drive efficiency and reduce operational costs, making services more attractive to consumers. Moreover, the application of AI in predictive maintenance can significantly decrease downtime, thereby improving service reliability. As a result, the incorporation of these technologies is likely to propel the growth of the iot telecom-services market, as businesses seek to harness the full potential of their IoT investments.

Increased Focus on Sustainable Practices

Sustainability has emerged as a critical driver in the iot telecom-services market, particularly in Japan, where environmental concerns are paramount. Telecom companies are increasingly adopting sustainable practices to reduce their carbon footprint and enhance their corporate social responsibility. This shift is evident in the deployment of energy-efficient technologies and the use of renewable energy sources in network operations. Reports suggest that companies implementing sustainable practices can achieve cost savings of up to 20% in operational expenses. Additionally, consumers are becoming more environmentally conscious, leading to a preference for service providers that prioritize sustainability. Consequently, this focus on eco-friendly initiatives is likely to stimulate growth in the iot telecom-services market, as businesses align their strategies with consumer values and regulatory expectations.

Rising Demand for Connectivity Solutions

The iot telecom-services market in Japan experiences a notable surge in demand for connectivity solutions, driven by the proliferation of smart devices and applications. As businesses and consumers increasingly rely on IoT technologies, the need for robust and reliable connectivity becomes paramount. Reports indicate that the number of connected devices in Japan is projected to reach over 1 billion by 2025, highlighting the urgency for telecom providers to enhance their infrastructure. This rising demand compels telecom companies to innovate and expand their service offerings, thereby fostering growth within the iot telecom-services market. Furthermore, the integration of 5G technology is expected to play a crucial role in meeting this demand, as it provides the necessary bandwidth and low latency required for seamless IoT operations.