Regulatory Support

Regulatory frameworks play a crucial role in shaping the insuretech market in India. The Insurance Regulatory and Development Authority of India (IRDAI) has introduced initiatives to promote innovation and competition within the sector. For example, the sandbox approach allows startups to test new products in a controlled environment, fostering creativity and reducing barriers to entry. This regulatory support is essential for the growth of insuretech firms, as it encourages investment and collaboration. As the regulatory landscape continues to evolve, it is expected that the insuretech market will benefit from increased innovation and a more competitive environment, ultimately enhancing consumer choice.

Increased Investment

Investment in the insuretech market is witnessing a notable surge in India. Venture capitalists and private equity firms are increasingly recognizing the potential of technology-driven insurance solutions. In 2023 alone, investments in the sector reached approximately $1 billion, reflecting a growing confidence in the market's future. This influx of capital is enabling startups to develop innovative products and services that cater to the diverse needs of consumers. As more investors enter the space, the insuretech market is likely to experience accelerated growth, fostering a dynamic ecosystem that encourages competition and innovation.

Technological Advancements

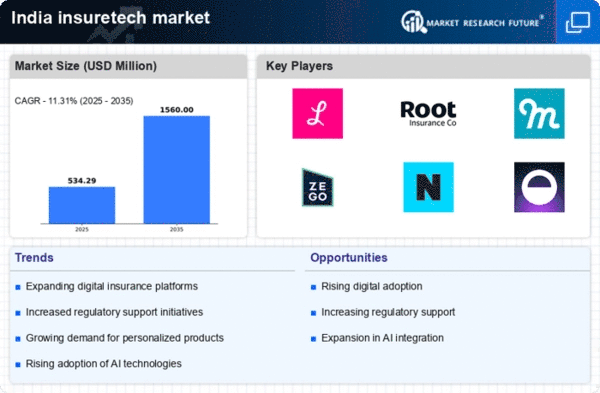

The rapid evolution of technology is a primary driver for the insuretech market in India. Innovations such as artificial intelligence, machine learning, and blockchain are transforming traditional insurance processes. For instance, AI-driven analytics enable insurers to assess risks more accurately, leading to tailored policies. The market is projected to grow at a CAGR of 30% from 2023 to 2028, indicating a robust demand for tech-driven solutions. Furthermore, the integration of mobile applications facilitates seamless customer interactions, enhancing user experience. As technology continues to advance, it is likely that the insuretech market will witness increased investment and innovation, ultimately reshaping the insurance landscape in India.

Changing Consumer Expectations

Consumer expectations are evolving, significantly impacting the insuretech market in India. Today's customers demand personalized services, quick responses, and transparency in policy offerings. This shift is prompting insurers to adopt digital platforms that provide real-time information and user-friendly interfaces. According to recent surveys, over 70% of consumers prefer online channels for purchasing insurance, highlighting the need for companies to adapt. Insurers that leverage data analytics to understand customer behavior can create tailored products that meet specific needs. As consumer preferences continue to shift towards digital solutions, the insuretech market is likely to expand, driven by the demand for enhanced customer experiences.

Rising Awareness of Insurance Products

There is a growing awareness of insurance products among the Indian population, which is significantly influencing the insuretech market. As financial literacy improves, more individuals are recognizing the importance of insurance in risk management. This trend is particularly evident among younger demographics, who are increasingly seeking digital solutions for their insurance needs. The penetration rate of insurance in India is currently around 3.76%, indicating substantial room for growth. As awareness continues to rise, it is anticipated that the insuretech market will expand, driven by a more informed consumer base seeking accessible and affordable insurance options.